In our last investment update, we speculated that a decisive General Election result in the UK and ‘phase one’ of a US/China trade deal meant that the outlook for 2020 appeared good.

Fast forward three months and the world is facing its toughest moment in a generation. The coronavirus pandemic has affected almost every country in the world, and drastic measures taken by governments have had a devastating impact on the global economy.

Here’s our review of one of the most volatile and unpredictable quarters in recent memory.

UK

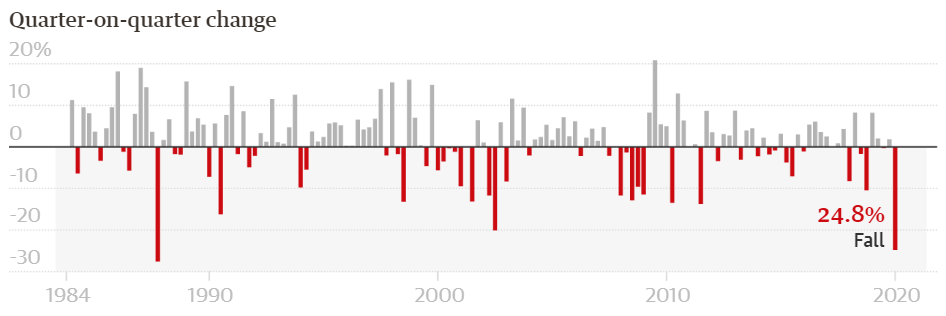

The ramifications of the coronavirus saw the FTSE 100 post its biggest quarterly fall for more than three decades. The leading index of UK company shares fell by 25% in the three months to the end of March, the biggest quarterly contraction in London-listed share values since the aftermath of Black Monday in October 1987.

Indeed, March 12th saw the FTSE 100 register its biggest single-day fall in more than 30 years.

On the final day of a month of unprecedented chaos on global financial markets, the FTSE 100 closed up almost 2% at 5,672. Indeed, in the last couple of weeks of March, it appeared as if the index was returning to some semblance of normality. The FTSE 100 overall actually rose in seven of the last nine trading days of Q1, although at the end of March the index is around 2,000 points below where it started the year, when it was near the highest levels on record.

Source: The Guardian

Worst hit were shares in travel companies, airlines and banks. Shares in cruise operator Carnival, which has seen some of its ships placed into quarantine, fell by more than 75% in three months, while International Consolidated Airlines, the owner of British Airways, has fallen by around 67%.

Europe

March saw shares across Europe suffering the worst month on record. With some European nations hit particularly hard by the coronavirus, drastic lockdown measures saw share prices across the continent plunge.

The Italian stock market fell by 27%, marking its worst quarter on record, while the pan-European Stoxx 600 fell by 23% in the worst quarter since 2002. Shares in European travel and leisure companies have collapsed by almost 42% to mark the worst three-month period in history.

US

Markets in the US saw unprecedented falls that mirrored the rest of the world. Wall Street went through ‘the fastest bear market in history’ with the Dow Jones average falling by 23% from its previous peak in little more than 20 days, faster than the slide that occurred during the 1929 Wall Street crash.

Q1 2020 was the worst first quarter ever for the Dow and S&P 500. The Dow fell roughly 23% over the first three months of the year (the worst overall quarter for the Dow since 1987), and the S&P 500 dropped about 20%, its worst quarterly decline since 2008.

Other headlines included:

- The Dow fell by 13.74% in March, its worst month since October 2008

- The Dow is 25.9% below its intraday all-time high of 29,568.57 seen on February 12th

- Volatility was extreme, with the closing up or down more than 1% every day in March with the exception of March 19th

- The S&P closed down 12.5% over the month of March, its worst month since October 2008.

Goldman Sachs have estimated that Q1 real GDP in the US will come in at – 9%, with Q2 looking drastically more ominous, at –34% GDP growth.

Rest of the world

Even before the coronavirus pandemic, the price of oil had fallen significantly. However, during the quarter oil prices fell by more than 65% to around $22 a barrel as demand for crude slumped with the global economy heading for recession.

Hopes of a price war truce could support prices, if Saudi Arabia and Russia can strike a deal quickly.

The green shoots of an economic turnaround have begun in China as the first country to be hit by Covid-19 begins to lift travel restrictions in the central city of Wuhan after two months of lockdown.

Chinese companies reported a rebound in economic activity in March as firms gradually reopen. The manufacturing purchasing managers’ index published by China’s National Bureau of Statistics increased to 52.0 this month, up from a record-low level of 35.7 in February on a scale where a reading above 50.0 separates economic growth from contraction.

Mihir Kapadia, chief executive of Sun Global Investments, said: “We still have long months of battle as the US has just started dealing with it. Global economic growth and trade will continue to be affected until the disease is contained across the world. But as China shows, there is hope at the end of the tunnel.”

However, Vicky Redwood, a senior economic adviser at the consultancy Capital Economics, warned that consumer and business confidence could remain subdued, especially if it takes longer than anticipated to return to normal or there is a second wave of the virus.

“It may well take a few years to get back to where we were and even longer for some economies,” she said.

Get in touch

If you need advice on any aspect of our Q1 2020 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Production

Production