We’re completely transparent about all fees and charges. Everything you need to know about what we charge is on this page and will be discussed with you at your initial meeting with us, so you know exactly what you’re paying for and why.

Measuring success

We never take on a new client if we don’t think we can produce financial returns for that client many times greater than our fees. However, we also know that our clients receive value through working with us in lots of other important ways, too, including:

- “Knowing I have a go-to person for my financial affairs” James P.

- “Providing a safe pair of hands” Harriet S.

- “Support and assistance in meeting my financial / life goals” Phil P.

- “Stonegate’s knowledge and experience” Lionel P.

How we charge for our services

Initial consultation

We cover the costs of your initial meeting with us. This meeting helps us to understand your financial objectives and helps you to decide whether we are the right advisers for you. During the meeting, we will confirm whether and how we can support you in working towards your goals.

We will also discuss the cost, and levels, of our services both initially and throughout our relationship with you.

Financial review and recommendation

This can be a continuation from the initial discussion, where agreed, or a further appointment. This process covers the:

- Gathering of information about your existing financial arrangements and full personal circumstances

- Understanding of your investment knowledge and attitude and tolerance towards investment risk

- Recommendation of an asset allocation model that matches your risk profile and the subsequent assessment and suitability of any existing holdings

- Preparation of our recommendations to you

- Arrangement of a second appointment to explain and discuss our recommendations in detail with you.

Our charge for this service is a fixed fee of £1,600.

This fee is payable on the provision of the report containing our recommendation(s) to you.

This fee will be waived wholly or in part should you decide to implement any of our recommendations.

Policy arrangement and implementation

Lump Sum Investments or Transfers

(Subject to a minimum, total fee of £3,000 and a maximum, total fee of £20,000.)

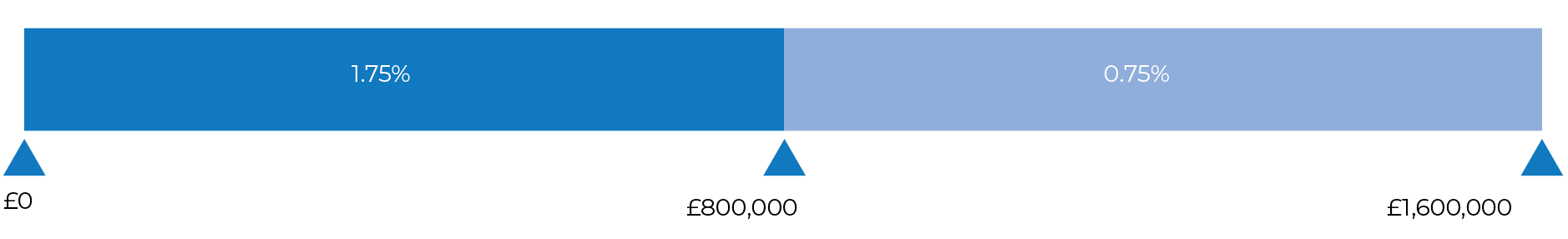

Should you instruct us to proceed with (any of) our recommendation(s), our charge for this service is based on a percentage of the amount you invest and/or transfer. These charges are applied in line with the sliding scale above.

This payment can either be made by the product provider when they receive your funds or paid directly by you. When you make this payment, we will waive our “financial review and recommendation” fee by the same amount.

Fee examples

Example 1: If we arrange investments on your behalf totalling £100,000 our Policy Arrangement & Implementation fee would be our minimum fee of £3,000.

Example 2: If we arrange investments on your behalf totalling £500,000 our Policy Arrangement & Implementation fee would be £8,750 (1.75% of £500,000).

Example 3: If we arrange investments on your behalf totalling £1,000,000 our Policy Arrangement & Implementation fee would be £15,500 (1.75% of the first £800,000 and 0.75% on the remaining £200,000).

Policy Arrangement & Implementation – Regular Savings/Investments

Where there is a recommendation to make a lump sum investment and/or a transfer, we will charge 1.75% of the first 12-month premiums of any regular savings or investments. The minimum fee for both the lump sum investment or transfer and the regular savings will be £3,000.

Example 1: If we arrange investments on your behalf totalling £100,000 and a regular contribution to savings or investment of £250pm our Policy Arrangement & Implementation fee would be our minimum fee of £3,000.

Example 2: If we arrange investments on your behalf totalling £500,000 and a regular contribution to savings or investment of £250pm our Policy Arrangement & Implementation fee would be £8,803 (1.75% of the first £500,000 and 1.75% of £250 x 12).

Where there is no recommendation to make a lump sum investment and/or a transfer and you wish to commence regular contributions we will charge a flat fee of £1,600 (payable in advance).

Non-Investment Protection and General Insurance contracts

When we arrange the sale of a protection or insurance contract, we will not charge you a fee, as we will receive a commission from the provider/insurer. The amount of this will be disclosed to you in the product literature.

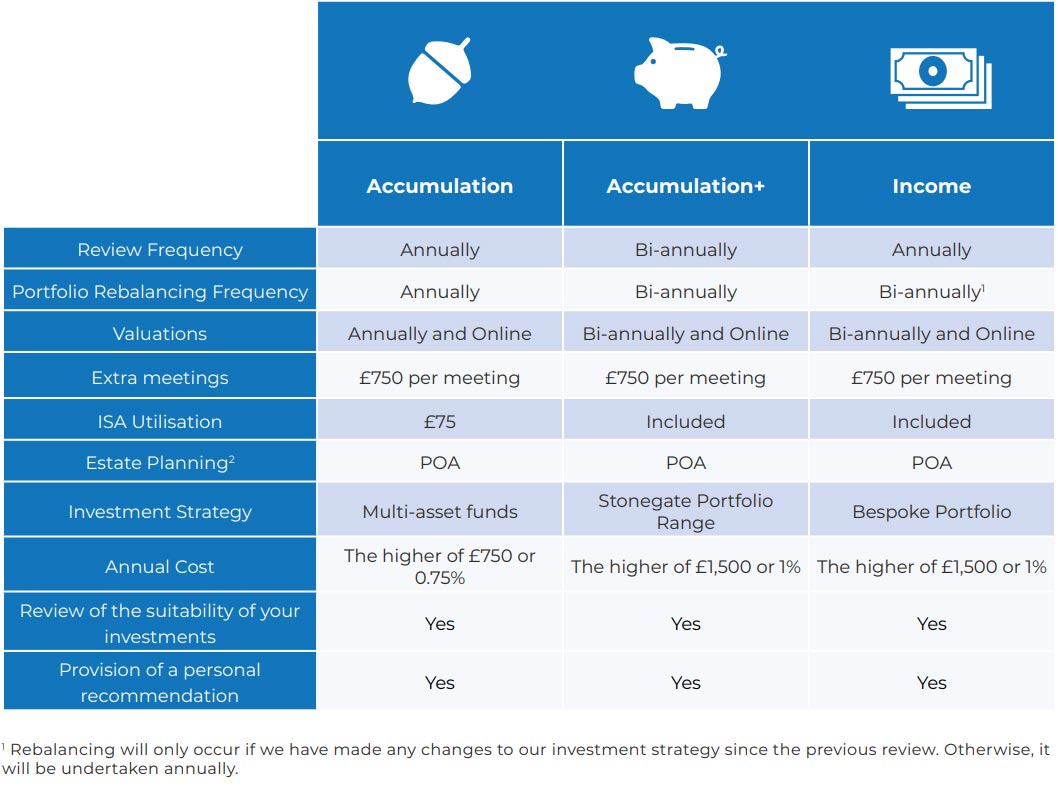

Ongoing services

It is important to review every investment you hold at regular intervals. We will discuss our ongoing services with you when we present our recommendations to you.

We currently offer three levels of service. They are:

Example 1: if you select our “Accumulation” service and your investments are valued up to £100,000, you will be charged our minimum annual fee of £750 per annum and this would be the total ongoing advice fee payable for that year.

Example 2: if you select our “Accumulation” service and your investments are valued at £200,000 you will be charged 0.75% per annum which equates to £1,500 and this would be the total ongoing advice fee payable for that year.

Example 3: if you select our “Accumulation+” service and your investments are valued up to £150,000, you will be charged our minimum annual fee of £1,500 per annum and this would be the total ongoing advice fee payable for that year.

Example 4: if you select our “Accumulation+” service and your investments are valued at £200,000 you will be charged 1% per annum which equates to £2,000 and this would be the total ongoing advice fee payable for that year.

Example 5: if you select our “Income” service and your investments are valued up to £150,000, you will be charged our minimum annual fee of £1,500 per annum and this would be the total ongoing advice fee payable for that year.

Example 6: if you select our “Income” service and your investments are valued at £200,000 you will be charged 1% per annum which equates to £2,000 and this would be the total ongoing advice fee payable for that year.

Where the value of your investments rises, then the fees for this service will increase, conversely, if the value of your investments falls, the cost of this service will decrease. This is subject to the above minimum charges.

You can choose to pay this fee directly or by deduction from the policy(ies) you hold.

Payment of fees

Payment of our ongoing charges can be made either by:

- Monthly deduction from your investment(s), where the product / platform provider is able to offer this facility.

- Direct invoice. The fee can then be paid by BACS or Cheque.

VAT

Under current legislation, our services are generally not subject to VAT but should this change in future and VAT becomes payable, we will notify you before conducting any further work.

Production

Production