During 2020 and 2021, the government borrowed an estimated £303 billion in the first full year of the Covid pandemic, a report in the Guardian reveals. Little surprise then, that in March 2021 the chancellor announced a series of tax changes in a bid to replenish the nation’s coffers.

Then, in September 2021, the prime minister announced further tax changes to tackle Britain’s growing social care crisis. This included an increase in National Insurance contributions (NICs), which the government says will help it invest £39 billion into health and social care over the next three years.

So which tax changes came into effect as the 2022/23 tax year began? Read on to find out.

1. Tax threshold and allowance freezes

As we start the 2022/23 tax year, several tax thresholds and allowances have been frozen until April 2026. We will consider these now.

Personal Allowance

This is the amount you can earn before you’re liable to Income Tax and remains at £12,570. The 40% higher-rate tax threshold stays at £50,270.

According to the BBC, the freeze could result in 1.3 million people paying more Income Tax, as salaries could continue to rise while the threshold remains the same.

Speaking to a financial planner could ensure your earnings are as tax-efficient as possible, and provide options that might help you reduce your Income Tax liability.

Lifetime Allowance

The Lifetime Allowance (LTA) is the amount of money you’re allowed to have in your pension pot and receive tax relief. It has been frozen at £1,073,100 until April 2026.

While you can have more money in your retirement fund, if you access any amount above the LTA you could face a tax charge of up to 55%.

If the investments within your pension pot continue to grow while the allowance remains static, your retirement fund could be exposed to the charge for the first time, or face a larger liability. That said, as it is only payable on money you withdraw over the LTA, you may not need to worry.

A financial planner can confirm whether you could face a tax charge or not and provide options to potentially reduce your liability.

Capital Gains Tax annual exemption

The exemption remains at £12,300 until April 2026, meaning you can make a profit of this amount on assets you sell before being liable to Capital Gains Tax (CGT). Some assets, such as your home, are typically exempt from the tax.

Depending on the asset you sell and your marginal tax rate, your CGT liability could be between 10% and 28%.

As your assets may increase while the exemption remains the same, you could be liable to a higher CGT charge.

That said, there are ways you may be able to lower any liability. For example, you may want to consider splitting ownership of an asset with your spouse or civil partner, as this would effectively increase the annual exemption to £24,600.

Inheritance Tax thresholds

The Inheritance Tax (IHT) nil-rate band remains at £325,000 and the residence nil-rate band at £175,000, meaning you may be able to leave up to £1 million to loved ones IHT-free. The tax is typically charged at 40%.

As the value of your home and other assets could increase in value while the thresholds remain frozen, your estate might face a larger IHT liability. There is good news though, as the government provides several ways for you to potentially reduce, or even negate, your estate’s liability.

This could include gifting or placing your money in investments that can be passed to beneficiaries IHT-free. As these can carry risk and effect on your long-term financial security, always speak to a financial planner before doing so.

2. ISA allowances remain the same

As the chancellor has not lowered the amount you can contribute into ISAs in 2022/23, you can place a total of up to £20,000 in the tax-efficient accounts. You can also contribute up to £9,000 into a Junior ISA (JISA).

As ISAs are not typically liable to Income Tax and CGT, you could build significant amounts in a tax-efficient environment relatively quickly.

3. Increase in Dividend Tax

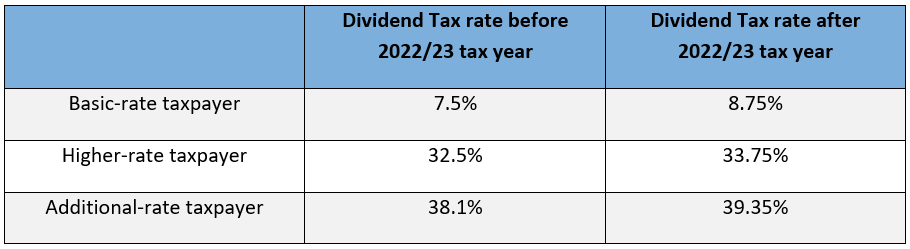

As the table below reveals, in 2022/23 Dividend Tax increased by 1.25 percentage points.

That said, the Dividend Tax Allowance remains at £2,000, which means you could receive an income from investments before becoming liable to the tax. For example, if you have £50,000 invested, you could take an average dividend of 4% before Dividend Tax is due.

4. National Insurance contributions increase

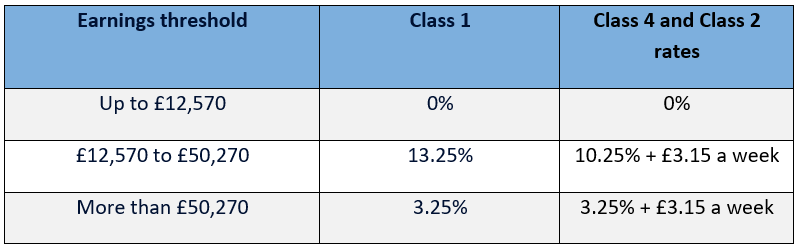

While National Insurance contributions (NICs) increased by 1.25 percentage points in the 2022/23 tax year, the chancellor also increased the NICs threshold to £12,570 from 6 July 2022. This means that the threshold is lower in the three months between April 6 and July 5.

As such, if you earn between £9,881 and £50,270 during the period, you will typically be liable to Class 1 NICs at 13.5% if you are employed. If you’re self-employed, you will be liable to Class 4 NICs at 10.25%, and Class 2 NICs at £3.15 a week.

After 6 July NICs will be charged at the following rates:

Source: Which?

Get in touch

According to Which?, even with the threshold increase, if you earn more than £35,000 a year you’ll typically pay more in NICs. Speaking to a financial planner could help, as they might be able to reduce your liability.

If you would like to discuss this, or other ways you could be more tax-efficient in 2022/23, email us on admin@stonegatewealth.co.uk or call 01785 876222.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production