After several months on the campaign trail, Donald Trump confirmed his second term as President in November, generating both optimism and apprehension in global financial markets.

While markets experienced volatility before the election and some dipped immediately afterward, such fluctuations are not unusual. Historically, the long-term effects of US elections on financial markets have been minimal.

Over time, US and global markets have trended toward growth, regardless of which party is in power, and have shown resilience in recovering from dips triggered by significant events.

So, amid the considerable “noise” surrounding US elections – particularly one involving Trump – it is typically a good idea to stay focused on your long-term goals and avoid overreaction to short-term trends.

Read on to discover how the US election affected stock markets at the end of 2024.

Markets were volatile in the build-up to the election

Stock markets experienced volatility in the months leading up to the election, which is not unusual amid the uncertainty and speculation surrounding the election cycle.

While this noise can cause short-term market fluctuations, it is unlikely to have a lasting effect on long-term performance.

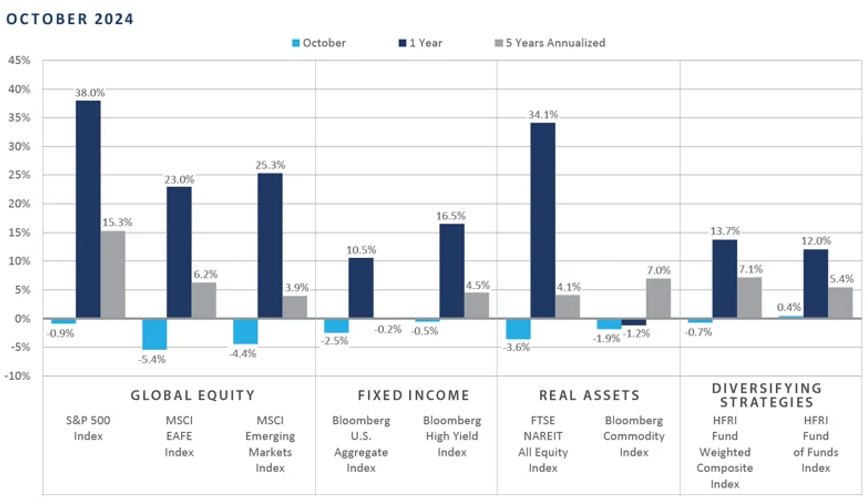

The graph below shows the performance of various asset classes and indices over one month, one year, and five years (annualised) leading up to the 2024 US election.

Source: FEG

As you can see, long-term performance has generally been strong across the board, but there were dips through October in the build-up to the election.

However, such fluctuations are unlikely to last much further beyond the election as it tends to be the uncertainty that drives the volatility rather than the predicted outcome.

For example, in 2016, as the contest between Donald Trump and Hilary Clinton heated up and the polls narrowed, global markets fluctuated amid the uncertainty.

Yet, on the day following the election, once Trump’s victory was determined, the Guardian reported that the Dow Jones, the S&P 500, and the Nasdaq all posted gains.

Initial market reaction has been positive in the US and the UK, but others have dipped slightly

Data from JP Morgan shows that in the wake of November’s election, US equities outperformed other regions. The S&P 500 rose by 5.9% over the month, while the UK’s FTSE All-Share achieved gains of 2.5%.

In contrast, other global markets experienced declines. The MSCI Europe ex-UK dipped by 0.1%, while the TOPIX and MSCI Asia ex-Japan posted losses of 0.5% and 3.3%, respectively. The MSCI Emerging Markets Index fell by 3.6%.

Despite these short-term losses, all major global markets have recorded positive gains for the year-to-date.

So, it’s good to remember that these initial market movements often reflect immediate sentiment and are unlikely to influence long-term trends.

US and global markets have trended toward growth in the long term, regardless of who is in power

While markets may experience volatility in the lead-up to an election and in the period following the results, historically, both US and global markets have generally performed well under administrations led by either Republicans or Democrats.

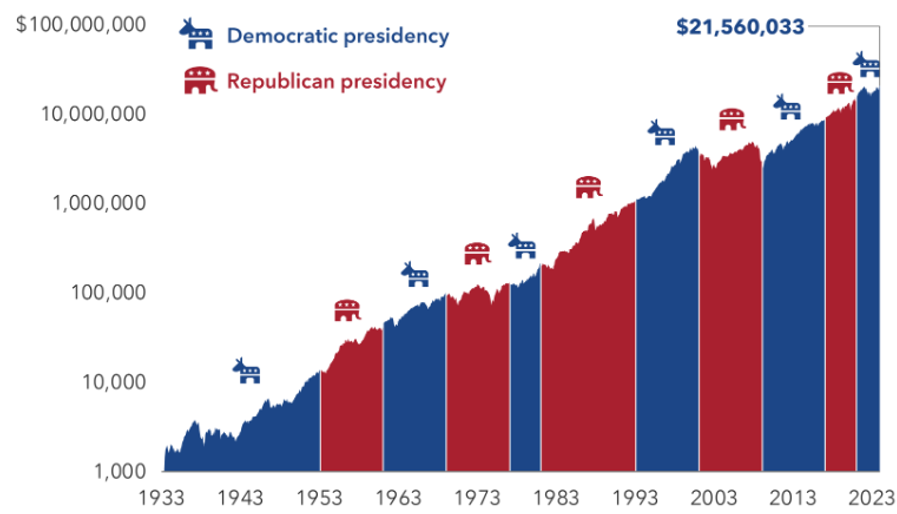

The graph below shows the growth of $1,000 invested in the S&P 500 from 1933 to 2023, alongside which US political party was incumbent at the time.

Source: Capital Group

As you can see, the stock market has historically trended upward over the long term, regardless of whether a Democrat or Republican president was in office. While there have been dips along the way, the market has consistently delivered positive returns over extended time horizons.

As you read earlier, markets outside the US and UK experienced slight dips following the announcement of Trump’s victory.

However, global markets tend to recover and return to posting gains over time, which demonstrates their resilience even after dips caused by significant crises, extending beyond the influence of any single political party.

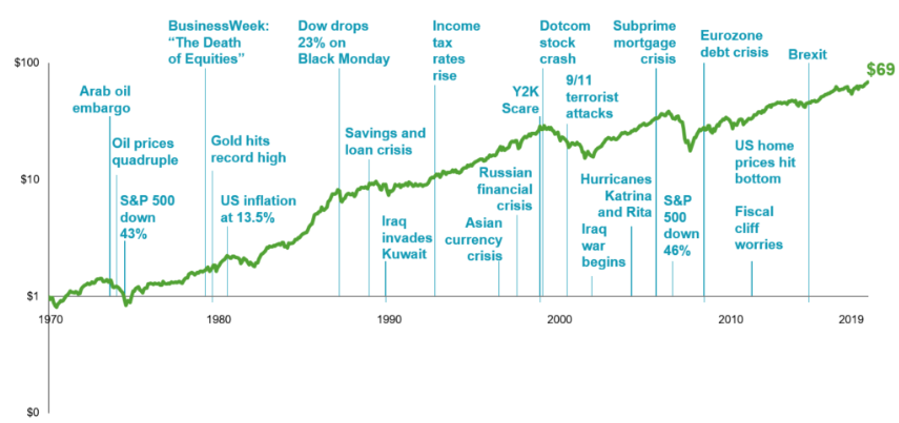

The graph below illustrates the growth of $1 invested in the MSCI World Index from 1970 to 2019, charted alongside major global events that triggered market downturns.

Source: Harvest

As the graph illustrates, significant events like the subprime mortgage crisis, 9/11, and the Arab oil embargo caused notable downturns in global markets. Yet, despite these dips, the market has consistently trended toward long-term growth.

Similarly, any financial consequences of Trump’s re-election are unlikely to have a lasting impact. Both US and global markets have historically shown resilience and have typically recovered and continued to grow over long time horizons.

The market reaction before and after the election highlights the importance of both diversification and a long-term investment approach

The positive returns in the US and UK, contrasted with losses in other regions, highlight the benefits of a well-diversified portfolio.

Diversification spreads risk and allows you to capture opportunities across various markets. It can help to cushion your investments against regional fluctuations and achieve more stable returns.

It’s generally also a good idea to maintain a long-term approach to investing. Immediate market movements following an election are often driven by sentiment and speculation.

Meanwhile, a comprehensive financial plan that is aligned with your long-term goals can help you navigate short-term uncertainty and take advantage of the market’s historic tendency to grow over time, regardless of which political party is in power.

Get in touch

A financial planner can help ensure you stay focused and on track to achieve your long-term goals amid market fluctuations and uncertainty, whether they are caused by an election or any other significant event.

To speak to a financial planner, get in touch.

Email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production