The last decade has been tough if you’re a saver. Interest rates have been at rock-bottom levels since the global financial crisis, and just when experts thought a rise might finally be on the cards, the coronavirus devastated the UK economy.

The Bank of England reduced interest rates twice in March and the Base rate now sits at just 0.1%. And, with the Bank considering reducing rates further to support the economy through the crisis, savers are facing even more cuts to already low rates.

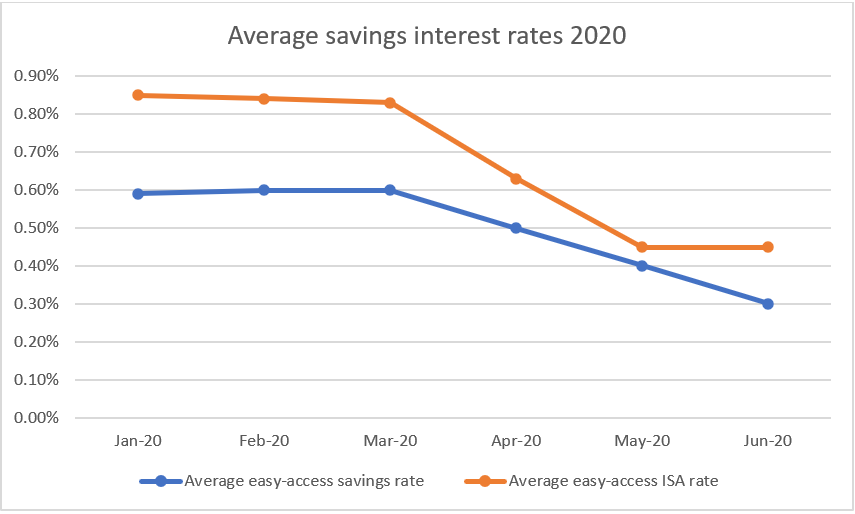

Easy-access savings rates halve in 2020

At times of financial uncertainty, savers often opt for easy-access accounts so they can retain quick access to their funds.

The latest research from financial analysts Moneyfacts has revealed that, in the first three months that the coronavirus pandemic impacted the UK economy, the average rate on an easy access halved, from 0.60% available in mid-March 2020 to 0.30% in June.

Rates on easy-access Cash ISAs have also tumbled in recent months, as this chart shows:

Source: Moneyfacts

Rachel Springall, finance expert at Moneyfacts, says: “Until savings providers desire savers’ cash once more, we are unlikely to see an influx of deals climbing the top rate tables – in fact, we are more likely to see a race to the bottom to cope with demand or see deals with a very short shelf life.”

Industry data which covers banks, including the UK’s biggest high street names, found £176 billion, or more than a third of savers’ money, earns just 0.1% interest.

And, while the average easy-access rate may now be lower than 0.5%, the UK’s biggest banks are routinely now paying just 0.01% interest on some accounts. That’s just £1 in interest on every £10,000 of your savings.

So, what can you do to improve your returns?

Shopping around

With interest rates so low, you might wonder why you would bother switching your savings. However, moving your cash could generate a significant uplift in returns.

For example, if you have £20,000 languishing in an account paying just 0.01% interest, you’ll earn £2 in interest a year.

At the beginning of July 2020, National Savings & Investment’s Direct Saver was offering an interest rate of 1% on savings from £1 to £2 million. If you transferred your £20,000 to this account, you’d increase your annual interest to £200 – a £198 increase over leaving it in a high street account at 0.01%.

Many newspapers and online resources publish ‘best buy’ tables and so it can pay to shop around and look for the best rates.

If you don’t require a fixed return and you were prepared to earn no interest but retain the chance of winning a cash prize, the current Premium Bonds prize rate is 1.4%. The odds of winning are currently around 24,500 to 1, so if you transferred your £20,000 savings into Premium Bonds, you’d expect to win one of the available cash prizes round about nine or ten times a year.

All Premium Bond prizes are paid tax-free, and you can withdraw your money at any time.

The other advantage of National Savings & Investments is that your money is 100% guaranteed by the Treasury, unlike other banks where you are limited to the £85,000 available under the Financial Services Compensation Scheme.

Don’t forget your Cash ISAs

If you have saved into various Cash ISAs over the years, it’s important not to forget these when you’re shopping around for a better rate.

You can choose to transfer old pots in full or just a percentage of them. Make sure that the new provider can accept an ISA transfer (for example, National Savings & Investments do not accept transfers into their Direct ISA).

It’s also important that your new ISA provider handles the transfer. If you withdraw your funds and seek to reinvest them, you will be subject to the rules surrounding new deposits. Your savings could lose their tax-free status as a result.

What could happen if the Bank of England adopts negative interest rates?

In recent weeks, the Bank of England has admitted it is considering implementing a policy of negative interest rates. Here, the Bank would essentially charge financial institutions for holding their cash, and banks could pass on these charges by levying fees to savers for holding their money.

However, industry experts think it is unlikely that banks will start charging people interest on their savings.

Andrew Hagger, founder of the financial information website Moneycomms, says: “Many would just withdraw cash and possibly keep it in the house, thus opening a can of worms around security and break-ins.

“However, if the Bank of England did introduce negative rates, I’m sure we would see even more savings accounts heading towards zero.”

There have been recent examples of banks charging clients for holding their savings, although this has been restricted to wealthy savers.

In 2019, UBS began charging its high net worth clients a fee for cash savings of more than €500,000 (£449,000), starting at 0.6% a year and rising to 0.75% on larger deposits.

Get in touch

If you’d benefit from a financial review to see if your money could be doing more for you, please get in touch. Email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note:

The Financial Conduct Authority does not regulate Deposit Accounts and NS&I products.

Production

Production