You may have noticed recent media reports revealing that inflation rose at its highest rate when it hit 3.2% in August 2021. This is according to the Independent, which reported that the rise from 2% in July 2021 to 3.2% was the greatest month-on-month rise since records began in 1997.

It may get worse before it gets better too, with the Bank of England (BOE) warning that inflation could reach 4% by the end of 2021/22.

So, what could this mean for your wealth, and is there anything you can do about it? Read on to discover what inflation is, how it could devalue your wealth in real terms, and why investing could help inflation-proof your money.

Inflation is the rise in cost of goods and services

Rises in the cost of living impact on everything from your mortgage repayments to the cost of your weekly shop. While a small amount of inflation is seen as a sign of a healthy economy, too much inflation has the potential to devalue your money in real terms.

To demonstrate this consider the following. The Bank of England (BOE) calculates that to have the same spending power of £100 in 2010, you would have needed to have £131 in 2020. This is because the average inflation rate was 2.7% a year during the 10-year period.

In other words your £100 needed to have grown by 31% during the decade to keep up with inflation.

The cost of fuel and food has driven recent increases in inflation

The Office for National Statistics, which publishes UK inflation figures, reveals the increase between July and August 2021 was largely driven by rising transport and fuel prices.

In addition to this, prices in restaurants and hotels have also risen, as has the cost of food and drink, all helping push inflation up. While this need not be a problem if your money is growing at the same rate as inflation, current interest rates on savings accounts probably mean your cash isn’t keeping up.

Low interest rates mean your money could shrink in real terms

According to the Guardian, in August 2021 the Bank of England (BOE) warned that interest rates would continue to fall to “new historically low levels”. Despite this, the article also reveals that more than £200 billion was put into cash savings since the Covid lockdowns began in March 2020.

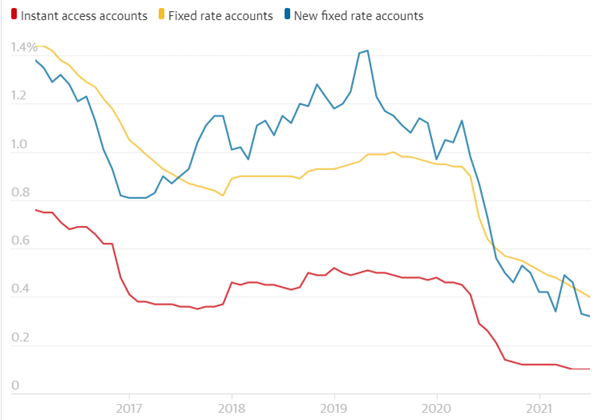

This is demonstrated in the graph below, which shows the average interest rates for three types of savings accounts during the five years up to August 2021.

Source: the Guardian

You can see that the average rate on all types of cash saving is now below 0.5%.

The article goes on to explain that in August 2021, one in every eight easy access savings accounts paid just 0.01% in interest. When you consider inflation stood at 3.2% at the time, if your money was in one of these accounts it could have been devalued real terms.

Investments could inflation-proof your money

One way you could inflation-proof your money is to invest it. This is because investments may provide better growth potential over the long term, something illustrated in the graph below.

Consider the following graph in comparison to the previous one. It shows the 20-year performance of the MSCI World index, one of the leading stocks and shares indexes that tracks the performance of a basket of companies across 23 developed nations. As you can see, despite downturns along the way, it has risen significantly since 2001.

Source: MSCI

Please remember, investing should not be entered into lightly and should be seen as a long-term venture. You may receive less than you invested depending on when you decide to access your investments.

Consider a Stocks and Shares ISA

One way you could benefit from the potential growth of investing and enjoy tax efficiency would be to consider a Stocks and Shares ISA. The accounts are free of Income Tax and Capital Gains Tax, meaning any money taken or growth made is tax free.

You can typically contribute up to £20,000 into ISAs during the 2021/22 tax year.

Get in touch

If you are considering a Stocks and Shares ISA, or any other investment to potentially inflation-proof your wealth, speak with a financial planner first. They can ensure the investment exposes your money to the right level of potential growth while ensuring the level of risk involved is appropriate for your circumstances.

If you would like to discuss the impacts of inflation on your wealth, or investing to inflation-proof your money, please get in touch by email on admin@stonegatewealth.co.uk or by calling us on 01785 876222.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

Production

Production