The issue of long-term care has been a political hot potato for years. So, when Boris Johnson became leader of the Conservatives in 2019 and pledged to “fix the crisis in social care once and for all”, many wondered how he would do it.

We recently found out: by raising National Insurance contributions (NICs) by 1.25 percentage points.

The move was aimed at boosting the NHS’s coffers post Covid, while also dealing with the issue of social care. The increase was part of the government’s Health and Social Care levy introduced in September 2021, something the Guardian reported could raise £36 billion over the following three years.

As he announced the tax increase in September 2021, Mr Johnson said it was not something he had done lightly. That said, when the measures do come into force in April 2022, most households in England will be hundreds of pounds worse off because of the increase in NICs.

There may be some good news, though, as you could potentially reduce your exposure to the contributions. Read on to discover more about the increase in NICs and two ways you may be able to reduce the amount you pay if you’re employed.

NICs will rise from April 2022

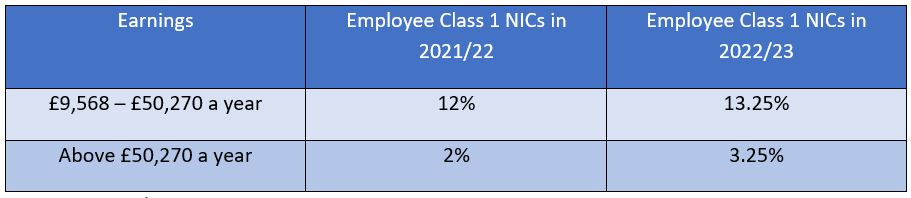

Many of us pay NICs from earnings to fund different state benefits systems, such as the State Pension and social care. From April 2022, the increase of 1.25 percentage points will apply to Class 1 NICs which are paid by employees. This is shown in the table below.

Source: Money Saving Expert

After 2023/24, the increase will be separated out. This means NICs revert to 12% and 2%, with the additional 1.25 percentage points appearing as a separate “Health and Social Care levy” on your wage slip.

All that said, there could be ways for you to reduce the amount of NICs you pay.

1. Salary sacrifice

This is where your employer agrees to contribute a higher proportion of your salary into your workplace pension. Typically, the money that goes into your pension is not liable to Income Tax or NICs, reducing your liability to the latter.

More than this, your employer will not have to pay the NICs it would normally be liable for either, so they may also be prepared to add the amount saved to your contributions. As this could help significantly increase the contributions, always ask your employer if this is something they would do.

While salary sacrifice may seem like a no-brainer, care should be taken. As the amount you earn reduces, this could impact on you in two ways:

- Mortgage – if you decide to apply for a mortgage, remember that your salary is lower. As such, a possible lender may not approve your application because it feels your salary is not high enough.

- Death in Service (DIS) – if your employer offers this as part of your benefit package, it could be reduced because of the salary sacrifice. This is because DIS is typically a multiple of your salary.

2. Artificially reducing your income

Salary sacrifice could provide an additional benefit. If you reduce your salary into the basic-rate tax band, you will no longer be liable to the additional rate of NICs paid by those in the higher-rate tax band and above.

As a basic-rate taxpayer, you would be liable for the 13.25% NICs up to £50,270 in 2022/23, but not the additional 3.25% higher rate. In addition, as a basic-rate taxpayer, you’ll pay 20% Income Tax, not the higher rate of 40%.

There is another advantage, which is not linked to NICs, but is an important point.

If you are a higher earner and you have not already done so, you might also want to consider using salary sacrifice to reduce your income to below £100,000. This is because when you earn above this level you typically start to lose your £12,570 Personal Allowance (2021/22).

The allowance is the amount the government allows you to earn before becoming liable to Income Tax, and reduces by £1 for every £2 you earn above £100,000. This means that if you earn more than £125,000 you typically lose your Personal Allowance.

Get in touch

If you would like to consider salary sacrifice, and discuss whether it’s the right thing for you, please feel free to contact us, we’d be happy to help. You can email us on admin@stonegatewealth.co.uk or call on 01785 876222.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

Production

Production