In January, there was significant market volatility after the Chinese AI company DeepSeek launched its chatbot. The model appeared to rival ChatGPT and other chatbots while operating at a fraction of the cost and with significantly less powerful chips.

According to Investor’s Business Daily, DeepSeek’s arrival wiped nearly $1 trillion off US tech stocks on the S&P 500 in a single day, with Nvidia alone losing almost $600 billion in value.

Although the market had stabilised by the end of February and Nvidia had regained most of its losses (though both have since fluctuated for various reasons), had you been overly concentrated in US tech stocks, you would have likely felt the dip more than others.

The events of January highlight the importance of having a balanced portfolio, diversified across different sectors, regions, and asset classes. Portfolio diversification not only offers protection against market downturns, but it can also open you up to wider returns.

Read on to find out how DeepSeek’s arrival reveals the value of having a diversified portfolio.

Diversification can help you avoid regional downturns

“Home bias” describes the tendency of investors to favour domestic markets they know and trust.

Although this approach may feel less risky, it can concentrate your portfolio, increase your exposure to the volatility of a single region, and cause you to miss opportunities for wider growth.

For example, if your portfolio was heavily weighted in US stocks in January, you may have experienced the downturn more severely than if you had been globally diversified. A balanced portfolio could have both cushioned the impact and also allowed you to benefit from gains in other markets – such as China – to offset any losses you made in the US market.

While the arrival of DeepSeek is a recent example, one constant in global markets is their unpredictability. Diversification can help stabilise your holdings amid short-term fluctuations, which are a regular occurrence in all markets.

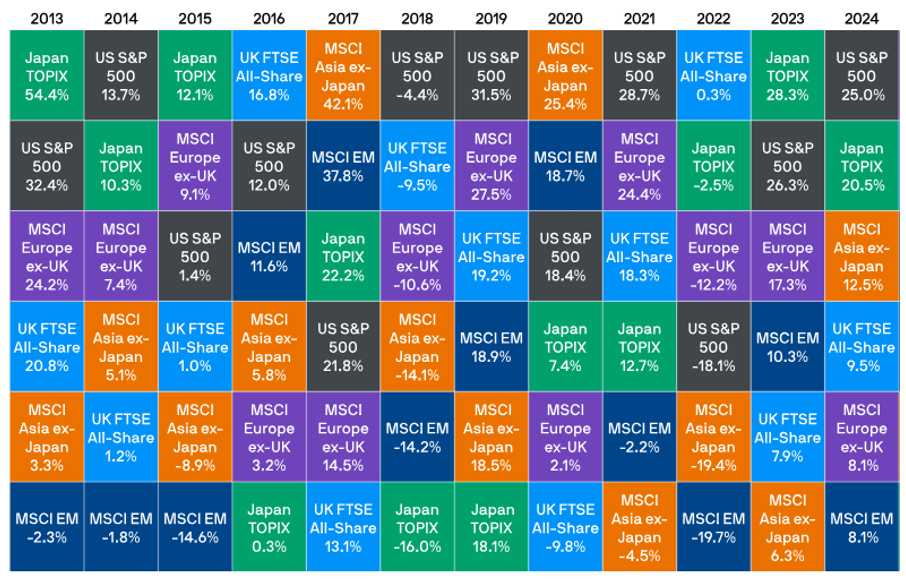

The chart below shows the annual returns of several major global indices between 2013 and 2024.

Source: JP Morgan

As you can see, past performance is rarely a reliable indicator of future returns, and it is nearly impossible to predict which indices will perform well based on previous rankings.

Take 2020, the first year of the pandemic, the MSCI Asia ex-Japan index surged by 25.4%, while the UK FTSE All-Share fell by 9.8%. Then, just a year later in 2021, the FTSE All-Share rebounded with an 18.3% gain, while the MSCI Asia declined by 4.5%.

If your portfolio had been heavily concentrated in either market during those years, you would have experienced significant volatility. This could have prompted you to exit the market in an attempt to limit losses – potentially missing out on future recoveries.

A globally diversified portfolio helps reduce these risks by providing greater stability and balance. It can also prevent reactive decision-making during short-term fluctuations, keeping your focus on long-term growth.

Diversifying across asset classes and sectors can also improve stability and help you achieve long-term, steady growth

As well as global markets, you can also diversify your investments across different asset classes and sectors. This can further serve to improve your stability and overall performance and can even help protect against inflation.

For instance, data from Select Sector shows that US tech companies have been the second-worst performer on the S&P 500, experiencing losses of 11.2% in the year-to-date (at the time of writing). However, over five years, the tech sector has been the second-strongest performer and delivered returns of 156.9%.

The tech sector’s relatively weak performance so far this year – partly driven by the arrival of DeepSeek – may overshadow its strong long-term growth. However, diversification can help you to stay resilient through short-term fluctuations by offsetting losses in one area with potential gains in another.

The same is true for asset classes. The chart below ranks different assets based on annual returns, between the years 2013 and 2024.

Source: JP Morgan

Just like regional markets and sectors, asset class performance is unpredictable and can change significantly from year to year.

For instance, in 2022, commodities was the strongest performer with a 16.1% gain, while growth assets experienced losses of -29.1%. The following year, their positions reversed, and growth assets grew by 37.3%, while commodities had a -7.9% return.

Diversification helps protect your portfolio from such volatility, and can offer a more stable path to growth.

Additionally, diversifying across asset classes can help your wealth keep up with inflation, as certain assets tend to perform better in high-inflation environments.

For example, house prices often rise faster than inflation, making property a potentially effective option for preserving and growing wealth during periods of high inflation.

In all instances, it’s important to remember that despite short-term volatility, markets trend towards growth in the long term, but diversification can help you weather fluctuations along the way.

Get in touch

A financial planner can help you to create a well-balanced and diversified portfolio based on your unique risk tolerance and goals.

To speak to a financial planner, get in touch.

Email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production