Your financial future is in safe hands.

We have more than 20 years of experience in financial advice and wealth management, and in that time we’ve learned what matters most…

You.

Our comprehensive portfolio of services is tailored and flexible to suit your individual and family financial needs, hopes and aspirations, but could include:

- Wealth management

- Cashflow modelling

- Retirement planning

- Pension reviews

- Investment advice

- Estate planning

- Inheritance Tax planning

- Protection

What is financial planning?

As financial planners, our job is to listen closely and carefully to ascertain just what it is that you want to achieve with your finances. Our next job is to assess your financial situation, tell you what’s possible with and without some changes, and in partnership with you, build a plan to help you reach your goals.

When you’re happy, we move forward together to implement your plan. From then onward we can provide an ongoing monitoring service to keep your investment plan fine-tuned and fully beneficial to you and your aspirations.

If you want to find out more about exactly how we do this, visit our “Financial planning process” page where we explain each stage of the process.

We’re independent financial advisers.

Our financial advice comes to you backed by over 20 years’ worth of experience in the investment and financial services sector. As a result, you benefit from thorough, detailed and unbiased advice on finding the right investments for you.

Our independence means you can be sure that all the financial advice you receive is delivered with your best interests at heart, all tailored to you and your goals.

We’re all different.

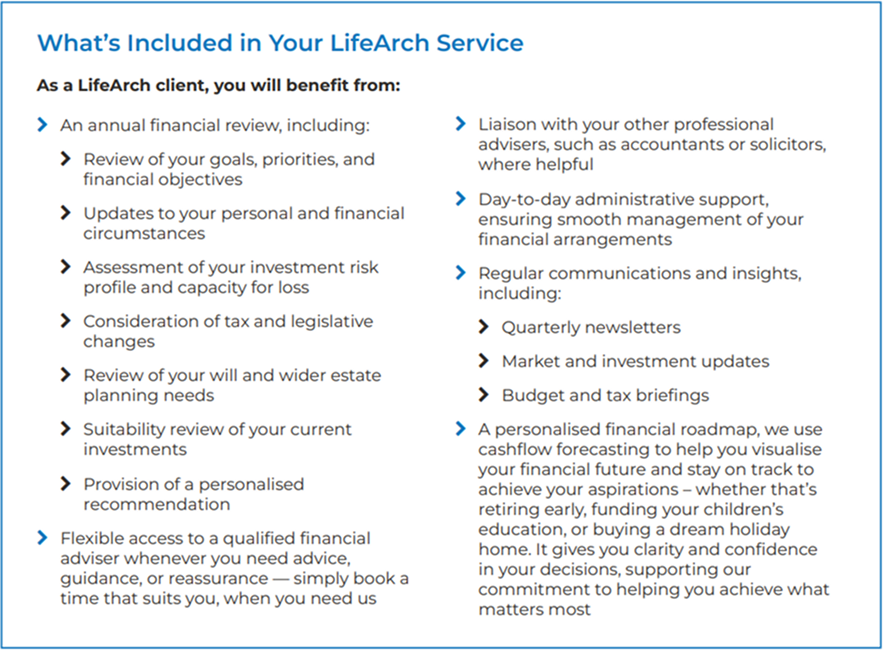

That’s why we’ve created LifeArch – a flexible, tailored framework to support your unique financial journey. It helps you make confident decisions, stay on track, and respond to life’s changes.

For clients drawing an income from their investments – often in retirement – LifeArch helps manage assets so your income can support your lifestyle sustainably over the long term.

With ongoing reviews, expert guidance, and responsive advice, LifeArch keeps you supported every step of the way, whatever life brings.

We offer a range of investment strategies designed to support clients who are taking, or planning to take, a regular income from their portfolio. For many people this is during retirement, when it becomes especially important to ensure that income remains sufficient for their lifestyle while staying sustainable over the long term. Our approach is centred on gaining a clear understanding of your circumstances, goals, and tolerance for risk, and then selecting an investment strategy that aims to provide a dependable income while protecting the long-term health of your portfolio. This ensures that the solutions we recommend are appropriate, transparent and aligned with what you need both now and in the future.

For information on what we charge for our services, visit Our Fees page.

Production

Production