Despite the world having to deal with Omicron, the performance of some equities was strong in the final quarter of 2021. This was mainly due to investors focusing on economic resilience and corporate earnings.

Supply chain issues continue to affect businesses and economies, and some nations imposed restrictions after the Omicron variant was reported in South Africa at the end of November. Fears the new variant could put the brakes on the world’s economic recovery waned as reports suggested its symptoms were less severe than previous variants for most people.

As before, measures were put in place to reduce the spread of Omicron that affected many businesses, particularly those in the travel and hospitality sectors.

The quarter also saw a rapid rise in inflation, both in the UK and many other countries. The Organisation for Economic Co-operation and Development (OECD) warned that surging inflation could undermine global recovery.

UK

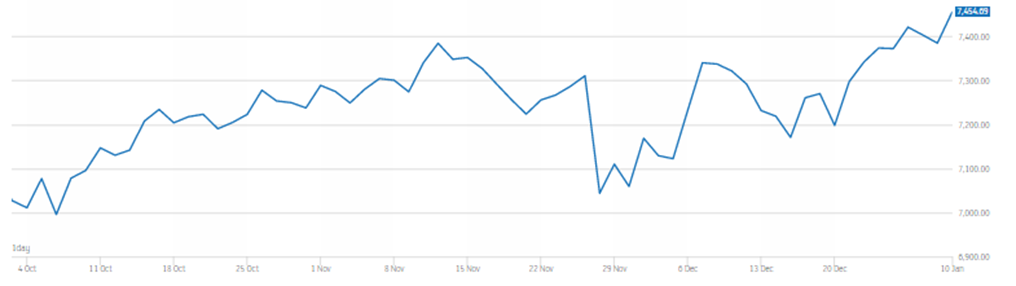

The FTSE 100 rose during the quarter, especially in the latter parts of 2021 as encouraging news around Omicron saw an uptick for industries that were still sensitive to uncertainty around Covid. As you can see from the graph below, the index finished significantly higher than it started despite the downturn in November, which was when Omicron was first reported.

Source: London Stock Exchange

In December, the Office for National Statistics revealed inflation stood at 5.1% in November, up from 4.2% the month before. November’s inflation rate was the highest rate for more than a decade, thanks in part to rising energy and fuel costs.

In response, the Bank of England increased its base interest rate from 0.1% to 0.25%. While it’s a small increase, the media reported it could reach 1% by the end of 2021.

Despite the FTSE 100’s performance, the outlook for the UK remained gloomy, with growth forecasts being revised downward. The CBI predicted that GDP growth in the UK will be 5.1% in 2022, which is considerably below the organisation’s previous forecast of 6.1%.

Data from IHS Markit (PMI), which monitors business activity in the UK, revealed increasing cost pressures continued to affect Britain’s manufacturers. Factories saw prices rise at their fastest rate since records began due to ongoing shortages of components, commodities, and labour.

Despite this, the PMI rose from 57.8 in October to 58.1 in November, suggesting that growth is becoming more rapid.

Europe

As with Britain, several nations in the eurozone introduced restrictions on the travel and hospitality sector in a bid to reduce the spread of Omicron. The region saw an increase in inflation, with its annual rate reaching 4.9% in November compared with -0.3% in the same month in 2020.

The European Central Bank (ECB) said it would not increase interest rates in 2022.

The flash composite purchasing managers’ index for the eurozone hit a nine-month low of 53.4 in December, as the service sector was affected by rising Covid cases.

Despite this, Europe’s shares made gains in Q4 thanks to a focus on strong corporate profits and an economic resilience that overcame worries about Omicron. Utility companies were among the top performers, although technology hardware and semiconductor stocks performed particularly well.

The European Commission is expected to propose stricter labour rules to regulate the gig economy. If successful, it could significantly reduce the profits of several companies that performed well during the pandemic, including food delivery services.

In Germany, Olaf Scholz of the Social Democrats (SPD) succeeded Angela Merkel as chancellor in December. His party is in a coalition government with the Greens and Free Democrats (FDP).

US

Stocks and shares in the US rose in Q4, with tech as a sub-sector being one of the strongest performers over the quarter.

That said, November’s performance was weaker because of the news of Omicron and concerns about the US Federal Reserve tapering the stimulus programme, which had been aimed at supporting the economy during the pandemic. By the end of the year fears over both were subsiding, especially as data suggested the economy remained stable and that corporate earnings were robust.

Much like the UK and Europe, the US struggled with supply chain issues and inflation. In 2021 inflation hit 6.8% – the highest since 1982, according to the Bureau of Labor Statistics.

Annualised GDP was 2.3%, up from the estimated 2.1%. That said, it was the slowest quarter of growth since the second quarter of 2020, when the economy suffered a historic contraction while dealing with the first wave of Covid.

Unemployment fell to 4.2%, the lowest since February 2020.

Asia

While the Japanese stock market regained some ground in December after declines in October and November, most of Asia saw a modest decline in equities in Q4. China was the worst-performing market in the quarter with a sharp decrease thanks to investors’ fears that new lockdown restrictions would come into force as Omicron spread around the globe.

India and South Korea also ended with modest declines in share prices, with Taiwan and Indonesia performing best in Q4, with gains in excess of 5% during the period.

Japan held a general election in October and its ruling Liberal Democratic Party (LDP) kept a solid majority. With the election out of the way, the focus shifted to a substantial fiscal stimulus package including cash handouts to households to kick-start a consumption recovery.

The country also saw a strong rebound in industrial production as auto output began to recover from the global semiconductor shortage.

Get in touch

If you would like to discuss your investments and their performance during Q4, please get in touch using our email admin@stonegatewealth.co.uk or by calling us on 01785 876222.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production