The fallout of Russia’s decision to invade Ukraine in February continued to be felt in economic terms during Q2 of 2022, especially in Europe because of its effects on energy imports and refugee flows.

Investor sentiment became gloomy over concerns that the conflict was accentuating rising global inflation and supply chain problems, which could tip the world into recession.

The Organisation for Economic Development’s (OECD) latest outlook predicts that global growth will decelerate to around 3% in 2022, and to 2.8% in 2023. This is much lower than previous projections made in December 2021, when it looked as though the world would bounce back from the Covid pandemic.

The World Bank also lowered its 2022 global growth forecasts from 4.1% to 2.9%, and warned the global economy could experience “stagflation”. This is where economic growth is stagnant, but inflation is high.

UK

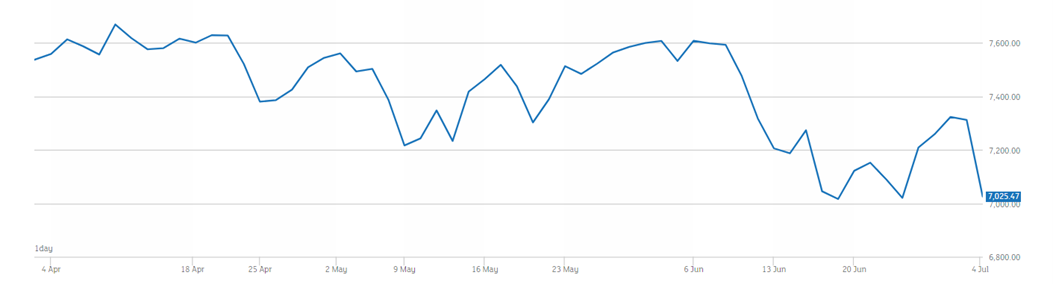

The FTSE 100 experienced a turbulent Q2 as fears grew about a possible recession. While some larger companies performed better, such as those in the telecoms and healthcare sector, the following illustration shows the index was down at the end of the quarter.

Source: London Stock Exchange

Retailers and housebuilders performed particularly poorly, although this trend was seen across many other developed nations.

The Office for National Statistics revealed that inflation stood at 9.1% in May, up from 9% the month before. This is the highest level for 40 years. One reason for soaring inflation was Ofgem’s 54% hike of the energy price cap in April, which prompted the then chancellor, Rishi Sunak, to unveil measures to help households cope with higher energy bills.

Another reason inflation continued to rise is the conflict in Ukraine, which has pushed food prices up due to supply problems and food shortages around the world.

In June, the Bank of England (BoE) increased its base rate to 1.25% to help tackle soaring inflation, the fifth time in quick succession. It also warned that inflation could reach 11% by the end of 2022.

Data suggested that the UK economy may contract in the coming quarters. The British Chambers of Commerce expects GDP to contract by 0.2% in the last three months of 2022, and the Confederation of British Industry (CBI) has warned that there is now a risk of a recession.

The flash composite purchasing managers’ index (PMI) for the UK was 53.7 in June, a 15-month low. That said, any figure above 50 represents expansion.

Europe

The war in Ukraine continued to weigh heavily on eurozone shares as concerns mounted over potential gas shortages. The following illustration shows the performance of the Euro Stoxx between the beginning of April and end of June.

Source: Euro Stoxx

Both the energy and communication sectors performed better, although technology and real estate fell sharply.

The ongoing war in Ukraine meant gas supplies to Germany continued to be disrupted, prompting the country to move into phase two of its emergency energy plan. As a result, gas supplies might be rationed for industrial users, and potentially households as well.

Germany is often seen as a European powerhouse, and a fall in factory orders for the third consecutive month may suggest that the country is heading towards a recession.

Inflation for the region was estimated to be 8.6% in June, up from 8.1% in May, something that has reduced consumer confidence in the region. The European Central Bank (ECB) indicated that it will increase rates by 0.25% in July in a bid to deal with rising inflation, the first time it has done so in more than a decade.

US

US stocks continued to decline in Q2, thanks largely to investors feeling nervous about rising inflation and the Federal Reserve (Fed) response to it. Inflation reached 8.6% in May, the highest level since December 1981, largely driven by skyrocketing energy and fuel prices.

In June, Wall Street entered a bear market as stocks dropped more than 20% from its peak, after the S&P 500 recorded its worst week since the Covid outbreak.

According to CNBC, 74% of American consumers are concerned about a recession. It’s understandable given that the US economy has showed signs that it could be heading towards one.

One of these signs includes the PMI easing from 53.6 in May to 51.2 in June. Furthermore, the higher number of jobless claims suggests US companies are letting staff go.

Asia

Stocks provided a negative return in Q2 as investor sentiment became more downbeat. This was because of concerns that rising global inflation and supply chain problems, made worse by the war in Ukraine, could trigger a worldwide recession.

Stocks in Taiwan fell due to fears that rising inflation and global supply chain problems might weaken demand for its technology products. China ended the quarter in positive territory, as Covid lockdown measures were relaxed and government data revealed that factory productivity had grown in June.

The Japanese stock market ended the quarter lower, thanks to increasing concerns over the country’s monetary policy and the growing possibility of a global recession.

Get in touch

As an investor, you may be concerned about the effect the current stock market and economic volatility could on your portfolio. Remember that short-term volatility is part of investing, and it’s usually better to focus on your long-term goals.

If you would like to discuss this or anything in this Q2 roundup, please contact us at admin@stonegatewealth.co.uk or by calling 01785 876222.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production