In the second quarter of 2025, global markets dipped early on following the introduction of sweeping US trade tariffs, but major indices rebounded and posted gains by the end of the period.

Asian markets outperformed, while European indices lagged behind. Although economic growth remained sluggish across most regions, a few outliers, such as Ireland, stood out with strong readings.

Read on for a closer look at how global markets fared in Q2 2025.

UK

According to the latest data from the Office for National Statistics (ONS), UK monthly real GDP fell by 0.3% in April 2025, following a 0.2% increase in March. However, GDP grew by 0.7% in Q1 2025 compared with the previous three-month period, largely driven by gains in the services sector.

Further data from the ONS reveals that inflation rose by 3.4% in the 12 months to May 2025, down slightly from 3.5% in April. The main downward pressure came from transport costs, while rising prices for food, furniture, and household goods offset the decline.

With inflation remaining above the 2% target, the Bank of England held the base rate steady at 4.25% during its June meeting but signalled that rates are likely to continue trending downward. According to the BBC, some analysts anticipate a potential rate cut as early as August.

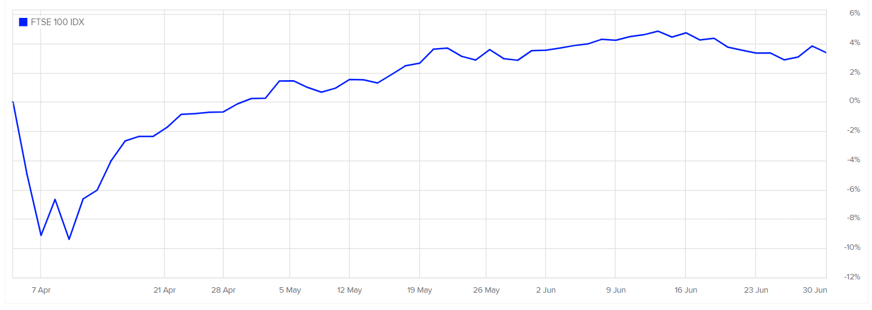

Despite a shaky start following the implementation of US trade tariffs, the FTSE 100 delivered a strong performance in Q2, rising by just under 4% – as shown in the graph below.

Source: London Stock Exchange

Furthermore, JP Morgan’s quarterly review shows that the UK FTSE All-Share index recorded a modest 4.4% gain in Q2, ranking as the second-weakest performer among major global indices. Nonetheless, the index remains solid in the year-to-date, with a 9.1% gain.

Europe

Trading Economics reports that eurozone inflation edged up to 2% in June, from 1.9% in May. While inflation in Germany declined unexpectedly, France and Spain saw slight increases, and Italy’s rate held steady.

Further reporting from Trading Economics notes that the eurozone economy expanded by 0.6% in Q1 2025, double the initial estimate of 0.3% and the strongest growth since Q3 2022. The surge was largely driven by Ireland’s impressive 9.7% increase.

Outside of Ireland, other countries have been slower. For example, the Netherlands and France both recorded 0.1% growth across the quarter. Indeed, the Guardian reports that the European Central Bank cut interest rates to 2% in an effort to boost flagging economic growth across the eurozone.

Meanwhile, JP Morgan’s review highlights that the MSCI Europe ex-UK Index was the weakest performer in Q2, posting a 3.6% gain. Despite this, it remains the third-strongest performer in the year-to-date, up 10.2%.

US

Data from Trading Economics reveals that US inflation edged up to 2.4% in May, slightly higher than April’s 2.3% (the lowest rate since 2021) but still below the expected 2.5%. The increase was driven by rising prices for food, transportation services, and vehicles.

Despite the inflation rise, the Federal Reserve kept interest rates steady at 4.25% – 4.5%, though the Chair has not ruled out the possibility of further rate cuts later in July.

Quarterly data from Trading Economics reveals that the US economy contracted at an annualised rate of 0.5% in Q1 2025, a sharper decline than the initial estimate of 0.2%. This marked the first quarterly contraction in three years, driven primarily by decreases in consumer spending and exports.

The JP Morgan market review reveals that after a rocky April, impacted by the Liberation Day trade tariffs, the US stock market rallied in late Q2. The S&P 500 posted a 10.9% gain for the quarter, making it the third-best performer, but the index remains the second-weakest performer in the year-to-date, with a 6.2% increase.

Asia

JP Morgan’s quarterly review shows that Japan’s TOPIX index rose 7.5% in Q2 but remains the weakest performer in the year-to-date, with a 3.8% gain.

The MSCI Asia ex-Japan index surged 12.7% in Q2, making it the best performer for the quarter and the second strongest in the year-to-date with 14.8% growth.

The latest figures from Trading Economics show that the annual inflation rate in Japan eased slightly to 3.5% in May, down from 3.6% in the previous two months, marking the lowest level since November 2024.

Further data from Trading Economics reveals that inflation in China declined by 0.1% in May. This marked the fourth consecutive month of consumer deflation, highlighting ongoing challenges including trade tensions with the US, weak domestic demand, and concerns over job security.

Get in touch

If you need advice on any aspect of our Q2 2025 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Production

Production