In the third quarter of 2024, global stock markets faced volatility after the US reported a rise in unemployment, prompting some analysts to predict a potential recession. Markets dipped in early August in response, but most had rebounded by the end of the month.

Despite a downturn at the close of 2023, major global economies have continued to grow. And, while inflation remains slightly above the target rate in many regions, it has generally stayed at manageable levels.

Read on to discover how markets performed in Q3 of 2024.

UK

The UK economy continued to recover after its brief slip into recession at the end of 2023, with Gross Domestic Product (GDP) growing by 0.5% in Q2, according to data from the Office for National Statistics (ONS). However, current estimations suggest no growth in June and July 2024.

Further ONS data shows a slight rise in inflation during Q3. After reaching the target rate of 2% in May and June, it edged up to 2.2% in July and August.

Despite this slight uptick, inflation has dropped considerably in recent months, returning to more manageable levels. In response, the Bank of England (BoE) lowered the base rate from 5.25% to 5% in August, marking the first cut since the pandemic. However, the BoE opted to keep rates unchanged in September to address the modest inflation rise seen in August.

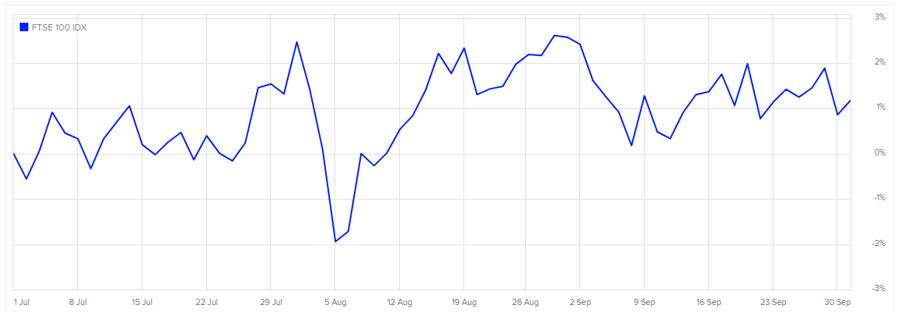

The FTSE 100 experienced some short-term volatility in Q3. Like other global markets, the index fell at the start of August as analysts widely predicted a US recession. It recovered by the end of the month, only to slide again at the start of September.

Notwithstanding this volatility, the FTSE 100 grew by 1.17% across the quarter, as you can see in the graph below.

Source: London Stock Exchange

Data from JP Morgan indicates that the FTSE All-Share grew 0.5% in August, continuing its positive performance so far in 2024.

Europe

Like the UK, the eurozone economy continued to grow, with GDP increasing by 0.3%, according to Eurostat data.

Eurostat’s research also forecasts inflation to drop to 1.8% in September, down from 2.2% in August, though the official figures are yet to be confirmed.

JP Morgan’s review reveals that the MSCI Europe ex-UK grew by 1.4% in August, which means it has recorded 12.5% returns in total for the year to date. This makes it the third-best performing index in the world so far this year.

US

Trading Economics confirms that in the US, inflation fell to 2.5% at the close of Q3, down from 3% at the end of the previous quarter. While this decline is encouraging, it still exceeds the Federal Reserve’s 2% target.

Additionally, data shows the Fed lowered the Federal Funds Rate to 5% in September, down from 5.5%, where it had remained for over a year.

Quarterly figures from Trading Economics also indicate that the US economy grew by 3% in Q2, up from 1.6% in Q1, with analysts no longer forecasting a recession.

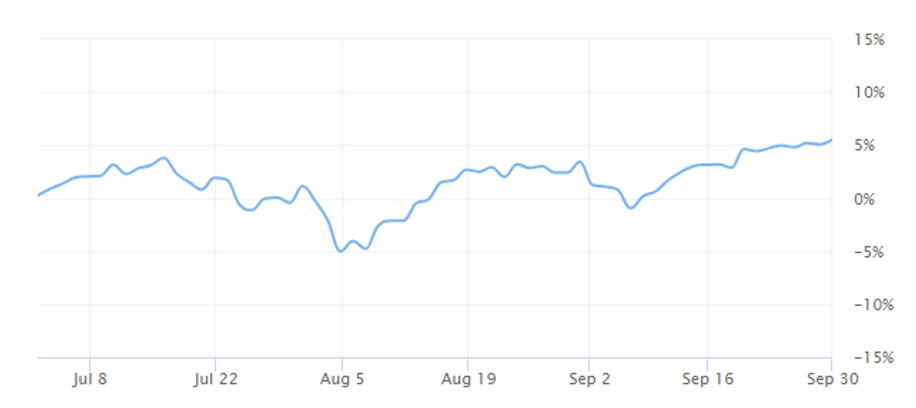

After a downturn in August, the S&P 500 rebounded, posting a 5.5% gain for Q3, as highlighted in the graph below.

Source: Barrons

In August alone, the S&P 500 posted 2.4% gains, making it the best-performing global index that month and in the year to date.

Asia

The data from JP Morgan reveals that Japan’s TOPIX fell by -2.9% in August, though it remains the second-top performer of 2024, having posted 16% in the year to date.

Figures from Statista show inflation in Japan to be slightly up in Q3, at 3% in August from 2.8% in June.

The MSCI Asia ex-Japan grew by 2% in August, positively contributing to its 12% growth in 2024 so far.

Get in touch

If you need advice on any aspect of our Q3 2024 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production