In Q3 2025, global markets expanded as trade tensions eased, with Asia leading the way in performance.

Inflation rose in several regions and remains above target in many economies, though China stands out as an exception.

Here’s a closer look at how key markets performed in the third quarter of 2025.

UK

The latest data from Trading Economics shows that UK GDP grew by 0.3% in Q2, down from 0.7% in Q1. Growth was driven by the services and construction sectors, while the production sector contracted.

Meanwhile, the Office for National Statistics (ONS) reports that inflation rose by 3.8% in the 12 months to August, unchanged from July. Air fares exerted the strongest downward pressure, while the prices of hotels, restaurants, and fuel all increased.

Inflation eased slightly early in Q3, prompting the Bank of England (BoE) to cut the base rate to 4% in August. However, as inflation then rose again, the BoE held rates steady in September and suggested that future reductions are likely to be gradual.

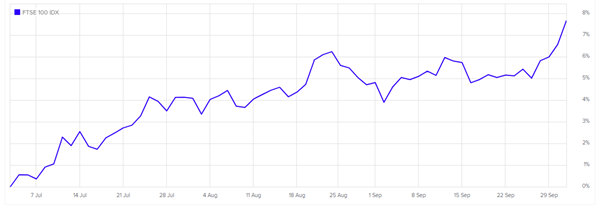

UK markets performed strongly in Q2, with the FTSE 100 rising by just under 8% – as you can see in the graph below.

Source: London Stock Exchange

Furthermore, JP Morgan’s quarterly review shows that the UK FTSE All-Share index recorded a 6.9% gain in Q3, with a 16.6% gain in the year-to-date. The strong market performance was partly driven by a weaker sterling.

Europe

The latest data from Trading Economics shows that Euro area inflation rose to 2.2% in September 2025, up from 2% over the previous three months. This slightly exceeds the European Central Bank’s 2% target and marks the first time since April that inflation has risen above this level.

Further reporting from Trading Economics notes that the eurozone economy expanded by 0.1% in Q2 2025, down from 0.6% in Q1, the slowest growth since late 2023.

JP Morgan’s review reveals the MSCI Europe ex-UK Index as the weakest performer in Q3, posting a 2.8% gain. It also remains the weakest performer in the year-to-date, though it has still increased by 13.4%.

US

Data from Trading Economics shows that US inflation rose to 2.9% in August 2025, the highest level since January, after holding at 2.7% in June and July. Price increases were strongest for food and vehicles.

Despite the rise in inflation, CBS reports the Federal Reserve cut interest rates to 4% – 4.25%, down from 4.25% – 4.5%, aiming to support the economy amid rising unemployment.

Quarterly data from Trading Economics indicates that the US economy expanded at an annualised rate of 3.8% in Q2 2025, above the second estimate of 3.3%. This marked the strongest growth since Q3 2023. The stronger-than-expected performance was driven largely by an upward revision to consumer spending.

JP Morgan reports that the S&P 500 grew 8.1% in Q2, although it remains the second-weakest performer year-to-date, with returns of 14.8%.

Asia

JP Morgan’s quarterly review shows that the MSCI Asia ex-Japan index surged 11.1% in Q3, making it the best performer of the quarter and the second strongest in the year-to-date, with 27.5% growth.

Japan’s TOPIX index was close behind for the quarter, rising 11%, though its year-to-date performance trails, growing 15.3%.

Meanwhile, Trading Economics reports that Japan’s annual inflation eased to 2.7% in August, down from 3.1% in July, marking the lowest rate since October 2024.

Further data shows that inflation in China fell 0.4% in August, following flat growth in July. This marked the fifth instance of deflation this year and the sharpest decline since February.

Get in touch

If you need advice on any aspect of our investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This article is for general information only and does not constitute advice. The information is aimed at retail clients only.

All information is correct at the time of writing and is subject to change in the future.

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production