After an uncertain and volatile year on the stock markets, Q4 delivered a welcome jump in value on many of the major global stock indexes. Read on to learn more about how falling inflation and potential future interest rate cuts affected markets around the world.

UK

Inflation has proved sticky in the UK, falling more slowly than its G7 peers. In Q4, economists were surprised to see inflation fall more quickly than they had anticipated. The Office for National Statistics reported that annual inflation fell to 3.9% in November 2023, a significant drop from the 4.6% rate recorded in October.

The good news has led markets to price in an anticipated cut to interest rates in early 2024, though the Bank of England maintains it is too early to consider cutting rates.

While the UK has avoided a recession so far, initial estimates suggest that Gross Domestic Product fell during Q3. This could mean that the economy is at risk of a recession in early 2024.

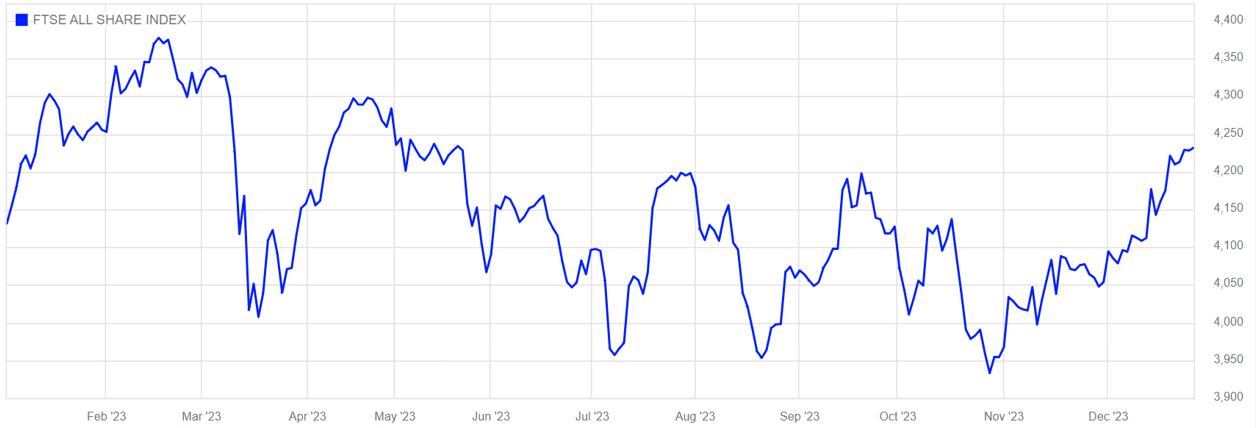

The FTSE All-Share delivered a positive return of 3.2% for Q4, bringing its annual returns for 2023 to 7.9%, as you can see in the graph below. The FTSE 100 delivered a smaller return of 2.4% for the year, lagging behind some of the other major stock markets in 2023.

FTSE All-Share annual returns for 2023

Source: London Stock Exchange

Europe

Inflation has fallen sharply in the eurozone across 2023. The European Central Bank (ECB) has maintained its commitment to keeping interest rates high for as long as needed to bring inflation down to its 2% target.

In November, inflation was recorded at 2.4%, but the ECB held rates steady at 4% – a record high. The economic bloc’s GDP contracted by 0.1% in Q3, and economists expect that Q4 will show further contraction. This would put the eurozone into a technical recession.

Despite the economic downturn, European equities delivered positive returns in Q4. The MSCI Europe ex-UK grew by 6.7% in Q4. Its year-to-date returns were even higher at 17.3%.

US

There was more good news relating to inflation in the US in Q4. The Consumer Prices Index rose by 3.1% in the 12 months to November, down from 3.2% in October and 3.7% in both August and September.

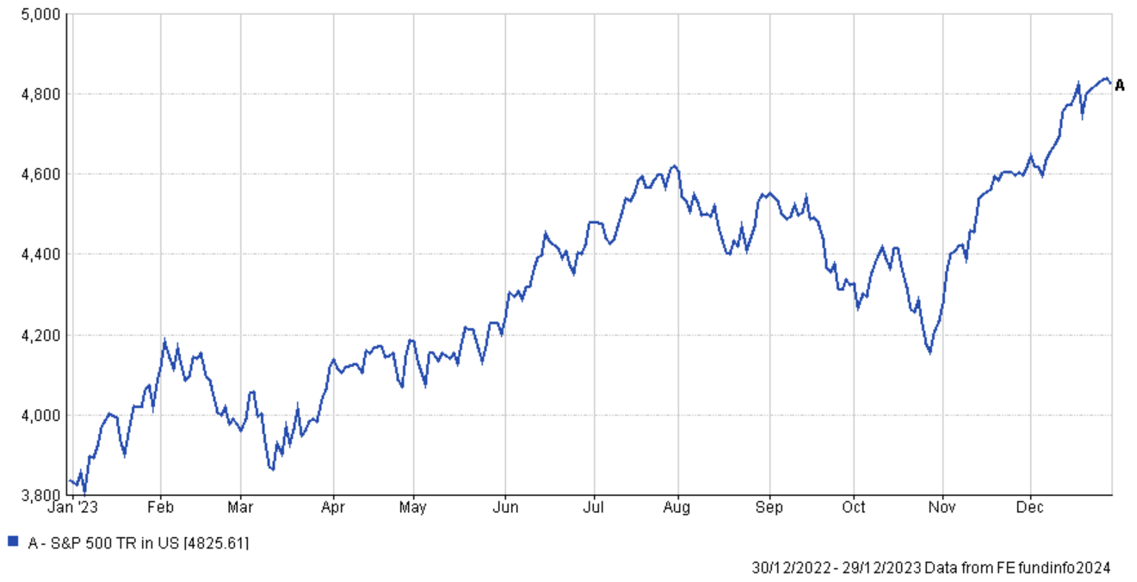

The Federal Reserve relaxed its stance on interest rates, pencilling in three cuts to the rate in early 2024. The optimism created a rally in equities, with the S&P 500 soaring to 11.7% for the quarter and 26.3% for the year, as you can see in the graph below.

S&P 500 annual returns for 2023

Source: FE fundinfo2024

Other stock indexes that also closed the year on a high were the Dow Jones Industrial Average, which returned over 13% for the year, and the Nasdaq Composite, which rose 43% across 2023. The late rally was driven in large part by exceptional performance of the so-called “Magnificent Seven”; some of the largest tech stocks in the world, including Apple, NVIDIA, and Microsoft.

Asia

One of the top-performing indexes in Asia, and indeed the world, in 2023 was the Japan TOPIX. While the index only rose 2% in Q4, its annual return was 28.3%.

Elsewhere in Asia, returns weren’t quite so high. Poor economic performance alongside a struggling property market and youth unemployment in China throughout 2023 weighed on equities in the country.

The MSCI Asia ex-Japan returned just 6.5% in Q4 and 6.3% for the year. Moreover, the Chinese blue-chip CSI 300 index fell more than 11% in 2023.

Get in touch

If you need advice on any aspect of our Q4 2023 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production