In the fourth and final quarter of 2024, inflation continued to edge above target levels globally with a knock-on for central bank interest rates.

US markets reacted positively following the confirmation of the presidential election result, while other indices, including the FTSE 100 and MSCI Europe ex-UK, experienced slight dips during the quarter. All major markets closed the year with positive overall gains.

Read on to discover how markets performed in Q4 of 2024.

UK

UK Gross Domestic Product (GDP) increased by 0.1% in Q3 of last year, according to data from the Office for National Statistics (ONS). However, the BBC reports that early indications are that the economy shrank at the start of Q4.

The ONS also reveals that inflation continued to rise in Q4, after reaching the Bank of England’s (BoE) target rate of 2% in Q2. The Consumer Prices Index (CPI) increased by 2.6% in the 12 months to November 2024, up from 2.3% in the 12 months to October.

In response to this slight uptick, the BoE decided to keep the base rate unchanged at 4.75% in its final monetary policy decision of the year.

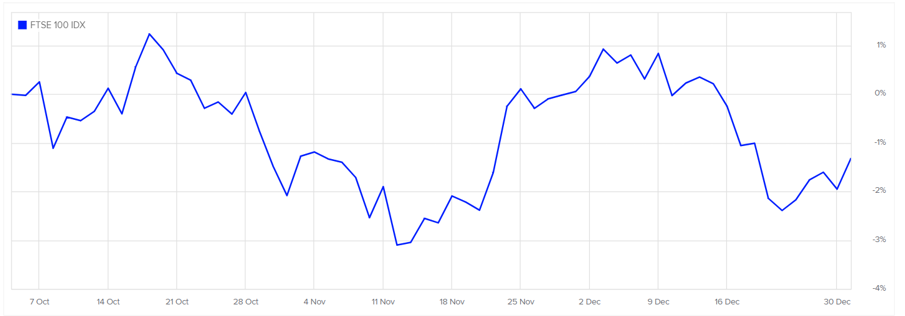

The FTSE 100 dipped by around 1.3% in Q3, with many analysts pointing to the Autumn Budget – which delivered larger tax rises than anticipated – as the key driver behind the slight fall, which you can see in the graph below.

Source: London Stock Exchange

Despite posting gains after Donald Trump’s re-election in November, the FTSE All-Share Index dipped across Q4, according to data from JP Morgan, recording losses of 0.4%. However, the Index grew by 9.5% in total across the year.

Europe

Data from Eurostat shows that the eurozone economy grew 0.4% in Q3, showing the strongest growth rate for two years.

Further research from Eurostat indicates that similar to the UK, inflation is on the rise in Europe, having reached 2.2% in the euro area and 2.5% in the EU.

JP Morgan’s review reveals that the MSCI Europe ex-UK dipped by 3.6% in Q3, though it posted gains of 8.1% in 2024. Despite this, it was the joint lowest-performing global market of the year.

US

As with the UK and Europe, the latest figures from Trading Economics reveal that US inflation rose in the 12 months to November, to 2.7%, up from 2.5% at the close of Q3.

Notwithstanding this slight uptick, further data shows that the Federal Reserve (Fed) continued to cut the Fed Funds Rate by a further 0.25%, bringing it down to 4.5% in December.

Quarterly figures from Trading Economics also indicate that the US economy grew by 3.1% in Q3, up from 3% in Q2 and 1.6% in Q1.

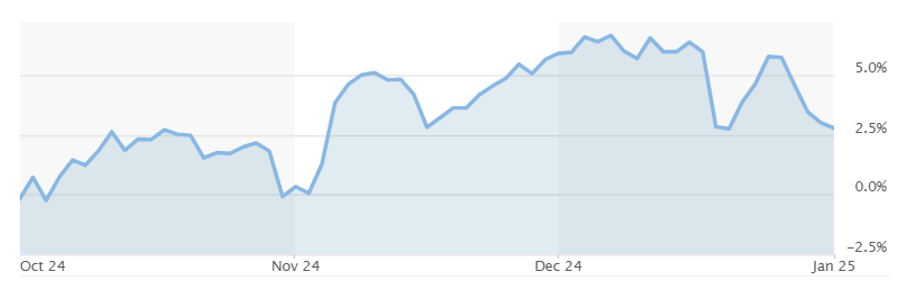

After a period of volatility in the build-up to the presidential election, the S&P 500 posted gains of around 2.5% in Q4, as highlighted in the graph below.

Source: Market Watch

JP Morgan’s market review shows that the S&P 500 was the strongest global performer in 2024, posting gains of 25% overall.

Asia

The data from JP Morgan reveals that Japan’s TOPIX was the top-performing global index in Q4, having grown by 5.4%. This put it in second place for the whole of 2024 with gains of 20.5%.

The MSCI Asia ex-Japan fell by 7.4% in Q4, though it remained the third-best performing index in the year as a whole with gains of 12.5%.

Figures from Trading Economics show inflation in Japan to be slightly up towards the end of Q4, at 2.9% in November, having previously fallen to 2.3% in October.

Get in touch

If you need advice on any aspect of our Q4 2024 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Production

Production