Around 24 million people hold Premium Bonds in the UK, each of them hoping to win big every month.

Premium Bonds are a government-backed savings product, offered by National Savings and Investments (NS&I). The minimum investment is £25, and the maximum is £50,000, as of the 2024/25 tax year.

Instead of earning regular interest, every £1 invested is given a unique number, which counts as one entry into a monthly prize draw. So, the more you have invested, the higher your chances of winning a tax-free prize, from £25 to £1 million.

The total value of current Premium Bond savings is around £124 billion, and they are the UK’s most popular savings product. However, NS&I recently announced a decrease in the prize rate.

In the wake of this change, read on to discover if Premium Bonds are still a sensible place to hold your cash and savings.

NS&I reduced the Premium Bond prize rate in March 2024

NS&I reduced the prize fund rate for Premium Bonds from 4.65% to 4.40% from the March 2024 draw.

There will still be two jackpot winners who take home £1 million. But there are now 232 fewer other high-value prizes worth £100,000, £50,000, £25,000, £10,000, and £5,000.

The number of prizes worth between £50 and £1,000 has also dropped by 355,224.

Meanwhile, the lowest value prize of £25 has increased by 397,554.

Prior to March 2024, there was a total of 5,843,447 prizes worth £475,510,350. There are now a total of 5,771,425 prizes worth £444,399,400.

Despite these changes, the odds of any £1 Bond number winning a prize remain the same at 21,000 to 1.

You could win big tax-free prizes on the Premium Bonds, but it is a lottery

The potential to win a significant tax-free prize is likely one of the reasons many people invest in Premium Bonds.

That said, because it is a prize draw, you do have to claim your winnings, which many people don’t – though you can also request your winnings be automatically reinvested to buy more Premium Bonds.

The Mirror reports that millions of Premium Bond prizes worth a total of £83,367,525 remain unclaimed, including six £100,000 prizes.

Despite the large number of unclaimed prizes, as with all lotteries, the odds are not in your favour.

If you stood everyone with £1,000 worth of Premium Bonds in order of their winnings, you would need to walk past 60% of the line until you hit the first £25 winner.

Indeed, for every £25 you invest, your chance of winning your £25 back is 1 in 840. And your chance of winning one of the two £1 million jackpots is 1 in 2,482,093,909. Though as you read earlier, the more you invest, the more chances you have to win.

The reality is, that the payout on your Premium Bond savings is likely to be minimal and below the current base rate of interest, which is 5.25%.

But if you win big, you can win very big.

So, Premium Bonds are a lottery, and every lottery involves a gamble. However, the gamble is not all-or-nothing, as you don’t lose your initial investment if you don’t win. Rather, you lose the potential interest you could have gained from other forms of investing.

Premium Bonds are very secure, but they can fall prey to inflation

Premium Bonds pose no risk to your capital and are backed by the treasury, meaning the money you invest is as safe as it can be.

While this guaranteed security was once a unique offering, UK-regulated accounts are now protected up to £85,000 by the Financial Services Compensation Scheme (FSCS), which is higher than the Premium Bond maximum investment value of £50,000.

Moreover, your savings in Premium Bonds could lose some of their real-terms value if you don’t win many prizes, as they may grow at a slower rate than inflation.

Typically, Premium Bonds are unlikely to beat inflation.

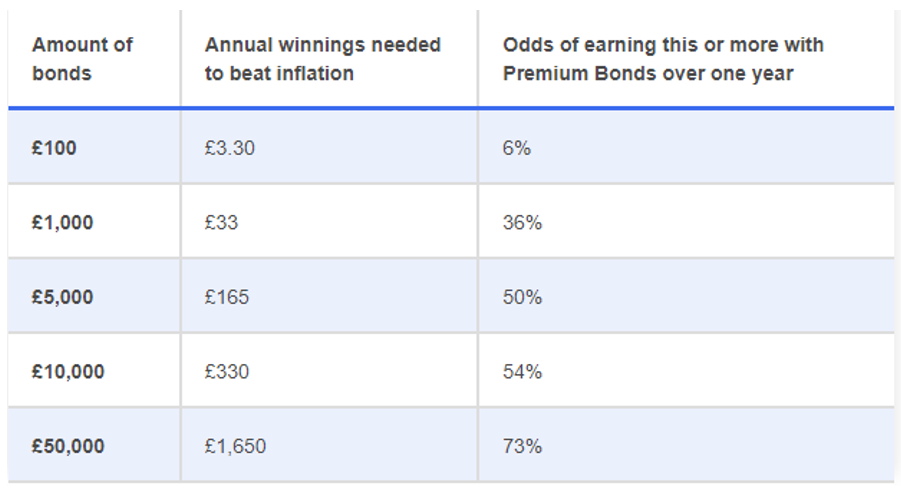

The table below shows the chance of beating 3.3% inflation at the current prize rate of 4.4%.

Source: Money Saving Expert

As you can see, it takes a £5,000 investment to reach a 50% chance of matching inflation, and even if you invest the maximum value of £50,000 your odds are below 3 in 4.

However, because of the relative security of Premium Bonds, they could be a good place to invest money for your children or grandchildren, alongside other tax-efficient options, such as a Junior ISA.

This is because you may not want to put money for your children in the market as the market doesn’t always yield gains. Over long horizons, Premium Bonds have the potential to return more than a regular cash account.

There’s no guarantee of returns, but Premium Bonds offer easy access to your cash

One of the main benefits of Premium Bonds is the ease of access to your cash, as you can sell your Bonds whenever you want without incurring a penalty.

If you put your money into a fixed-term savings account to secure a high interest rate, you may have to pay a penalty if you want to withdraw the funds before the end of the term.

Investments could also be less flexible as it can take time to process funds when selling your holdings and exiting the market. There is also the potential for you to make a loss if you need to liquidate your investments at short notice and do so during a dip.

Premium Bonds are easy to access and to liquidate, so they could be a good choice for wealth that you want to hold as an emergency fund or to put towards short-term goals.

However, if you are looking to build your wealth over longer horizons and you don’t need quick access to the funds, you might consider investing or using a fixed-term savings account instead.

So, it might be a better idea to determine whether Premium Bonds are a good saving option based on your need to access cash, rather than the potential of a big payout.

A financial planner can help you assess if Premium Bonds would suit your situation

As you have seen, there are pros and cons to holding your savings in Premium Bonds.

A financial planner can help you to understand if investing in Premium Bonds would be suitable for your current situation and future goals. They can also introduce you to other savings products that may be more conducive to your financial plan or explore how your savings may be best split between Premium Bonds and other products.

To speak to a financial planner, get in touch.

Email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production