Are you a labels person? Do you look for certain brands when you go shopping and, if so, do you do it for everything or just certain items?

It’s funny how a brand can alter the way we perceive things. One brand of breakfast cereal is better than another, or some tins of baked beans seem to taste better than others.

Whether they do or not is personal choice, but research by Scottish Widows has found that changing the way you see pensions could provide a £142,000 boost to your retirement nest egg.

It joined forces with the Behavioural Insights Team (BIT), a world-leading behavioural science organisation, to look at what motivates younger people to save more. As part of the study, psychological testing was conducted on 3,000 people aged 22-29 to understand their attitudes and expectations around finances.

As a result, researchers suggested that how you perceive a pension may impact on whether you’re contributing enough into it for retirement. They also suggested that small “nudges” might encourage you to contribute more to your pension.

While the study looked at younger people, its findings could easily apply to you if you’re older. Indeed, with potentially less time to boost your pension pot it may be even more applicable.

Read on to discover more.

Many of those questioned didn’t consider their retirement

Researchers found that one in three (37%) young people didn’t have a pension or didn’t know if they had one. If you’re one of them, it may be because of another finding which is that, of the 3,000 people surveyed, the majority were pessimistic about their retirement.

Nearly 22% expected to either retire after 70 or never stop working, with only around 10% saying they were highly confident they were saving enough for later life. The main reason provided for not putting enough aside for retirement was that there wasn’t enough money after paying bills.

That said, outside financial constraints, two of the most common reasons participants gave was that they hadn’t thought about retirement or didn’t know how to increase their contributions.

Seeing pensions differently could change people’s perception of planning for retirement

Part of the research was to look at ways of increasing engagement with pensions. To investigate this, participants were asked what they would recommend a hypothetical friend to do.

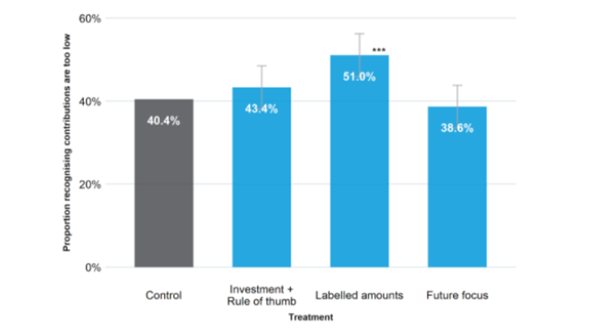

Each participant was provided with one of four different communications a pension company might provide, then their recommendation to the friend was recorded.

The four different communications included:

- Current marketing material from Scottish Widows.

- A pension framed as an investment rather than a savings plan.

- Labelled amounts, which explained that 12% of income should be contributed to a pension to stay above the poverty line. It also said that 15% was needed for a comfortable retirement.

- Future focus. Participants were asked to reflect on their retirement and life after work.

As the graph below shows, labelled amounts were the most effective communication in prompting participants to suggest their friend contribute more to their pension. After reading it, 26% recommended that the 8% minimum workplace pension contributions should be doubled as it wasn’t high enough.

Source: Behavioural Insights Team

Seeing pensions as an investment could help boost your pension pot

Researchers also found that when participants perceived pensions as an investment, they recommended their hypothetical friend increase contributions by more than one-third (34%).

What’s even more interesting is that, despite understanding how their hypothetical friend should act, participants weren’t necessarily motivated to contribute more towards their own pension.

The most effective communication to prompt for this to happen was encouraging participants to consider their future self and their retirement.

Working with a financial planner can help ensure you achieve this

According to the study, using labelled amounts, seeing pensions as an investment, and encouraging people to see their future self could provide important “nudges”. If these nudges are acted upon, it could boost the pension pot of someone aged under 30 by up to £142,450.

It’s not only under-30s though: these nudges apply to all ages. The good news is that financial planners already incorporate them to help clients, as they are essential in understanding someone’s situation and future aspirations.

Here’s how.

Labelled amounts

This helps you understand whether the contributions you make to your pension are sufficient is fundamental to a financial planner’s work. As such, they will assess your existing pensions and contributions and confirm whether the amount you have will provide the lifestyle you want in retirement. If it won’t, a planner will provide options to help you achieve your ambitions.

Framing a pension as an investment

A pension is typically an investment as an element is exposed to stocks and shares. Because of this, financial planners have a duty to explain the potential risk and rewards of pensions, their growth potential and whether they are likely to provide an adequate income in retirement.

Future focus

Key to a financial planner’s meetings is to understand your current situation and future goals. This means discussing with you how your “future self” will look, helping you to visualise the life you want when you stop working, and explaining what you need to do now to achieve it.

Get in touch

If you would like to discuss your retirement plans, your existing pensions and the options that may be available to you please contact us. This can be done by emailing admin@stonegatewealth.co.uk or by calling us on 01785 876222.

Please note

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment not normally accessible until 55 (57 from April 2028). Your capital is at risk. The value of your investment (and any income from them) can go down as well as up which would have an impact on the level of pension benefits available.

Production

Production