Living alone is one of those things that you likely either love or hate. But whichever camp you fall into, research reveals that there are now more people living alone than ever before.

Data reported by the Independent found that around 8.4 million people live alone in the UK, which represents roughly 3 in 10 households. Research by Statista shows that this figure has increased by nearly 2 million in less than 30 years. Experts estimate that by 2039, there will be almost 11 million people living in a single-person household.

While you may enjoy the peace and quiet of a solitary home, there are financial implications that can have a considerable effect in the long term.

Read on to discover the costs associated with living alone and some strategies to mitigate their effect on your wealth.

Living alone can be nearly twice as expensive as cohabiting, and pensioners potentially need up to £10,000 more a year

Living alone often results in higher overall costs for many expenses compared to sharing a home with a partner, relatives, or housemates. This includes a significant rise in housing costs, whether renting or paying a mortgage, as well as increases in household bills, monthly subscriptions, and grocery expenses.

Indeed, a further report by the Independent found that a single person living alone in the UK spends £1,851 on average on monthly bills (including food, internet, and a Netflix subscription), while individuals cohabiting as part of a couple spend around £991 – almost half as much. And this doesn’t include the tax advantages of being married, which can be considerable if used wisely.

This means that living alone can cost around £10,000 a year more than living with just one other person. When you consider that this could mean you are £300,000 worse off over 30 years, the financial implications are clear.

The extra costs associated with living alone can limit your ability to contribute to long-term financial goals and savings, such as your pension. Furthermore, single pensioners typically require significantly more income during retirement than those who are part of a couple.

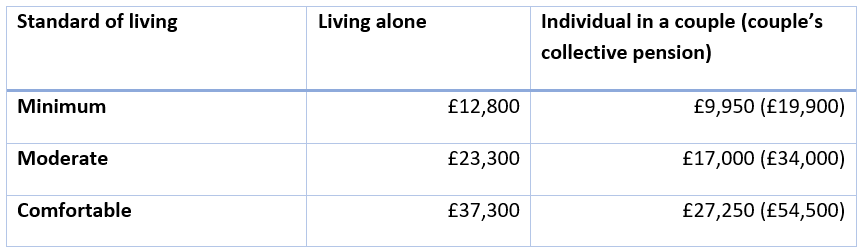

The table below outlines the estimated pension required for different standards of living in retirement, depending on whether you are an individual in a couple or living alone.

Source: The Guardian

As you can see, a single pensioner would need a minimum of nearly £3,000 a year more than an individual in a couple and could need over £10,000 more to sustain a comfortable retirement. This is a considerable ask when combined with the extra costs of living alone throughout your working life.

While living alone can be more expensive, there are several strategies you can implement to reduce your overall costs

Although it’s hard to completely circumvent the extra costs of living alone, there are a few simple steps you can take to reduce your overall expenses:

- Claim your Council Tax discount – If you live alone you may qualify for a 25% Council Tax discount, so be sure to claim it.

- Explore car-sharing schemes – Running a car is one of the biggest costs after property expenses. So, you may want to explore car-sharing schemes or add a named driver with a no-claims bonus to your policy.

- Make the most of your tax-efficient savings – Given the multiple tax benefits of being married and the expenses saved by cohabiting, it could be a good idea to ensure you make the most of all your tax-efficient savings allowances, such as ISAs and pension contributions.

- Cut your household bills – Cutting your household bills can save you significant amounts every year. You might consider using a smart meter to measure your energy use and find places to save, or installing a water meter, which is often a cheaper way to use water when living alone.

- Consider postponing your retirement – Postponing your retirement can have a considerable effect on your pension savings, as you not only make an additional year’s worth of contributions, but you also reduce the number of years you will need your pension.

- Consider letting a room – Letting a room would, of course, mean that you no longer live alone. However, if you have the space, having someone to split the bills with and provide you with a steady income can make a significant difference to your financial situation.

While some of these changes may seem small, their effect could be considerable over the course of several years. And, with the right financial planning, those extra savings could accumulate and contribute toward your long-term goals, such as building your retirement fund.

A financial planner can help you optimise your finances while living alone

A financial planner can help you optimise your finances if you live alone, providing tailored advice on managing your expenses, maximising savings and investments, and planning for your long-term financial security.

They can help you create a budget that reflects the unique costs of solo living, suggest strategies to reduce those costs, and ensure you are making the best use of your allowances.

Additionally, a financial planner can guide you on how to invest wisely, build an emergency fund, and ensure your retirement plan is on track – all while taking into account the financial challenges and opportunities that come with living independently.

To speak to a financial planner, get in touch.

Email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

This article is for information only. Please do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, which is subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Your home may be repossessed if you do not keep up repayments on a mortgage or other loans secured on it.

Production

Production