The beginning of 2022 has been dominated by Russia’s decision to invade Ukraine on Thursday 24 February. The shock invasion only further undermined an already volatile stock market, which had become nervous about increasing inflation, rising interest rates and the ongoing Covid pandemic.

According to the BBC, the Organisation for Economic Development (OECD) said that global economic growth could be cut by more than one percentage point in the first year after the invasion. Against this backdrop, Q1 has been a roller coaster ride for markets.

That said, many commodity prices soared in Q1. This is because Russia is a key producer of several commodities, including oil, gas and wheat, which meant demand for these goods from other countries increased.

This resulted in a further surge in inflation and contributed to supply chain disruption.

The invasion also helped push up energy prices, as many nations around the world boycotted Russian oil and gas. In April 2022, the Independent revealed that the average household bill could increase by £693 a year, following Ofgem’s 54% increase to the energy price cap.

UK

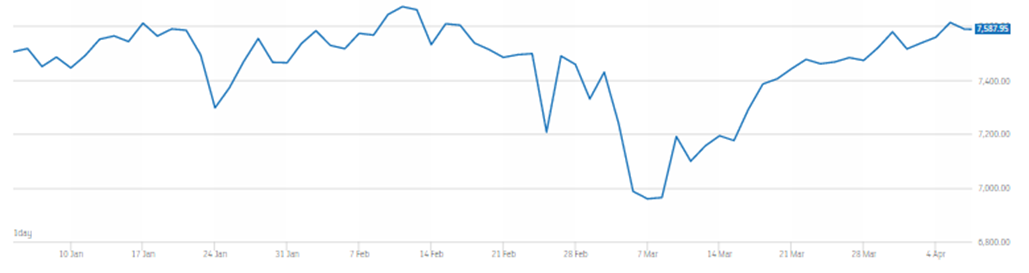

The FTSE 100 experienced an uncertain quarter as investor confidence ebbed and flowed because of rising inflation and interest rates. In addition to this, there was the ongoing Covid pandemic and Russian invasion of Ukraine.

As you can see from the graph below, despite significant downturns, the index remained resilient and finished slightly higher than it started in January. This was largely driven by the oil, mining, and banking sectors.

Source: London Stock Exchange

The Office for National Statistics (ONS) revealed inflation rose to 7% in March 2022, up from 6.2% in February. In January inflation stood at 5.5%.

The ONS also showed that rising inflation meant that basic pay had fallen by 1% in the year to February in real terms – the steepest decline since 2014.

As a result of rising inflation, the Bank of England (BoE) increased its interest rate to 0.75%, although the Guardian reported that some experts predict it will reach 1.25% by the end of 2022.

The chancellor, Rishi Sunak, delivered the spring statement on Wednesday 23 March, during which he revealed that the Office for Budget Responsibility (OBR) expects GDP to rise by 3.8% in 2022. This is significantly below the 6% forecast last October.

One of the biggest challenges facing households is increasing energy prices. In a bid to deal with this, the chancellor used his spring statement to announce a temporary 5p cut to fuel duty as prices at petrol stations soared.

He also said VAT would be cut for home energy efficiency installations.

A survey conducted by the British Chambers of Commerce (BCC) suggested that many businesses are facing post-Brexit challenges. According to the BCC, 71% of UK exporters believe the post-Brexit trade agreement isn’t helping them.

That said, some companies had a more positive start to the year. TUI, for example, reported that UK summer holiday bookings are up by 20% when compared to pre-Covid levels.

Europe

In a statement released by the European Central Bank, Christine Lagarde, says Russia’s invasion of Ukraine would have a “material impact on economic activity through higher energy and commodity prices, the disruption of international commerce, and weaker confidence”.

Little wonder then, that the invasion resulted in eurozone shares falling sharply, largely because of the region’s reliance on Russia for oil and gas. The graph below shows the performance of the Euro Stoxx 50 index during Q1, and as you can see, it ended the quarter below where it started.

Source: Euro Stoxx

As a result of Russia’s hostilities, Germany suspended approval for the Nord Stream 2 gas pipeline from Russia. The European Commission also announced its RePowerEU plan, which would diversify sources of gas and speed up the roll-out renewable energy.

Despite this, fears remain that high energy prices could damage economic activity.

Official figures revealed the annual eurozone inflation rate was 7.5% in March, up from 5.9% in February. Despite this, the European Central Bank (ECB) held its interest rate at 0%. That said, the ECB president indicated that rates could rise in 2022.

The flash composite purchasing managers’ index for the eurozone was 54.5 in March, down from 55.5 in February. Any figure above 50 represents expansion.

US

US stocks declined in Q1, following Russia’s invasion of Ukraine, which prompted strict sanctions from America and her western allies.

Like the UK, inflation in the US rose in Q1. In the 12 months to February 2022 inflation reached 7.9%, the highest for 40-years, according to the Labor Department.

Despite this, employment figures suggest that business remains confident, with March’s unemployment rate falling to 3.6% from 3.8% in February. The Federal Reserve raised interest rates by 0.25%, with further hikes expected through the rest of 2022.

Asia

After a weaker January and February, the Japanese stock market rose in March to end Q1 slightly below where it started. The rest of Asia didn’t fare as well though, with equities falling sharply amid a challenging environment created by the war in Ukraine.

Covid cases in Hong Kong and China rose to their highest level in more than two years, despite the Chinese government having one of the world’s strictest virus elimination policies.

China’s financial capital, Shanghai, went into a partial lockdown at the end of Q1 in an attempt to stem a surge in Omicron cases. This prompted fears that other parts of China might be next.

Get in touch

If you would like to discuss Q1 of 2022 and how it might affect your investments, please contact us at admin@stonegatewealth.co.uk or by calling 01785 876222.

Please note: This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production