Three months ago, in our Q1 update, we reported on one of the most volatile periods in stock market history. The arrival of the coronavirus in the developed world had a sudden and profound impact on western economies, with governments across the world adopting a series of unprecedented measures to support their people through the pandemic.

As lockdowns have eased and healthcare systems have begun to regain control over the virus, economies have begun to recover. Read about another dramatic three months in the world economy, and what could be next.

UK

The economic decline caused by coronavirus has been much deeper than after the 2008 global financial crisis. However, there are signs that the turmoil has bottomed out, thanks in part to the unprecedented size and speed of monetary and fiscal stimulus.

While experts are divided on how the UK economy will recover, there seems to be a consensus that it will end up in worse shape than it was going into the crisis.

The OECD has predicted an 11.5% decrease in GDP in 2020, followed by a 9% rebound in 2021. PWC estimates that the level of GDP may be around 1.5% to 7% below pre-crisis trends by the end of 2021.

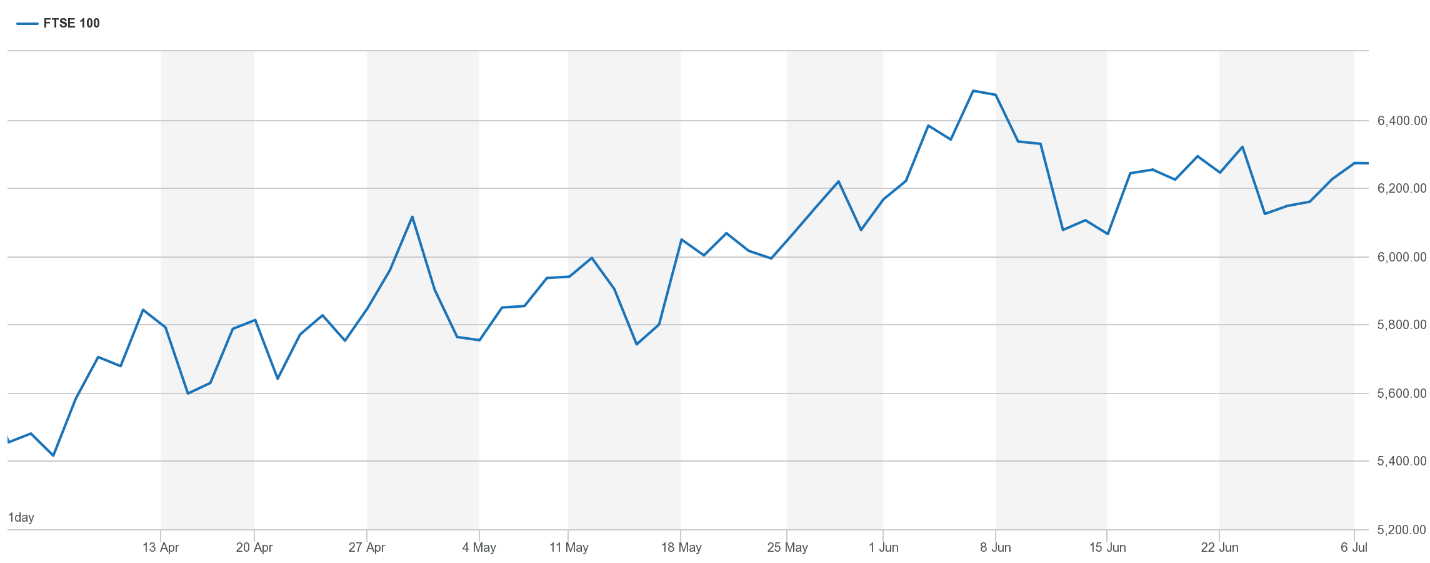

The UK’s FTSE 100 index actually rose by 15% in the second quarter of 2020 and, at the end of June, sat around 18% down compared to its highest point in 2020.

The Bank of England has been quick to provide support in recent weeks and is even keeping a negative interest rate policy under consideration if the economy requires further stimulus.

KPMG say that the unemployment rate could rise to 11% in 2021, while the weak economic environment is likely to see inflation remain well below the Bank of England’s 2% target. The inflation rate in May 2020 was just 0.5%, so more central bank stimulus could be needed to boost consumer spending.

US

It’s been the same story in the US, as record economic damage was swiftly followed by a significant bounce.

The second quarter of 2020 saw Wall Street’s biggest gains since 1998, as the S&P 500 gained almost 20% during the quarter. That rebound followed a 20% drop in the first three months of the year, the market’s worst quarter since the 2008 financial crisis.

Willie Delwiche, investment strategist at Baird, commented: “It’s the first time you’ve had back-to-back (quarters) like this since the 1930s.”

Despite sharp rises over the quarter, June remained a hugely volatile period. The S&P 500 Index saw greater than 4% rises and falls in 17 trading days through mid-June of this year, versus an annual average of just 3.2 days from 1928 to 2019.

Oil prices also bounced back strongly, with a barrel of U.S. crude oil at just under $40 at the end of June, nearly double where it was at the end of the first quarter.

Experts don’t believe that the recovery will continue at quite the same pace for the rest of 2020 and beyond. With rising coronavirus infection rates and a looming US Presidential election, there are still some uncertainties to come.

Europe

As in the UK and US, stock markets across Europe posted strong gains in the second quarter as countries began to lift lockdown restrictions. The Baltic countries and Austria were among the first to loosen their lockdowns in April, while worse affected countries such as Spain, France and Italy waited until later in the quarter before relaxing measures.

The European Commission president Ursula von der Leyen called for the power to borrow €750 billion for a recovery fund to support the worst affected EU regions, in addition to a €540 billion rescue package agreed in April. The European Central Bank also offered support, expanding its pandemic emergency purchase programme to €1.35 trillion.

However, it’s worth bearing in mind that political divisions remain between EU leaders on the size and the composition of a Covid-19 recovery plan.

Asia

After weakness in early April, the Japanese equity market recovered to record a total return of 11.3% over the quarter. The country took a different approach to ‘lockdown’ with restrictions much less severe than elsewhere in the world, with the official state of emergency lifted in May.

Elsewhere in Asia, equities recorded a strong return in Q2. Markets were encouraged by fresh stimulus from major central banks and the reopening of economies across the world, which particularly benefited export-oriented markets such as Taiwan and Thailand.

India’s central bank provided additional support in April which was followed by the announcement of a major fiscal stimulus package in May. China slightly underperformed, as exports fell by 3.3% year-on-year in May after expanding in April.

Get in touch

If you need advice on any aspect of our Q2 2020 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Production

Production