Stock markets performed well in the first quarter, driven partly by surprisingly strong economic growth in many countries around the world. Read on to learn more about how stock markets performed in the first three months of the year.

UK

The UK economy fell into a recession in the second half of 2023, but Gross Domestic Product (GDP) grew by 0.2% in January, returning the economy to modest growth. The Office for National Statistics shared that inflation fell from 4% in January to 3.4% in February.

In his Spring Budget, the chancellor announced further tax cuts on top of those announced in the Autumn Statement in 2023. These included:

- The main rate of National Insurance will fall by a further 2%

- The higher rate of Capital Gains Tax for residential property will fall by 4%

- The High Income Child Benefit Charge will be reviewed, and the threshold above which it becomes payable will rise initially from £50,000 to £60,000.

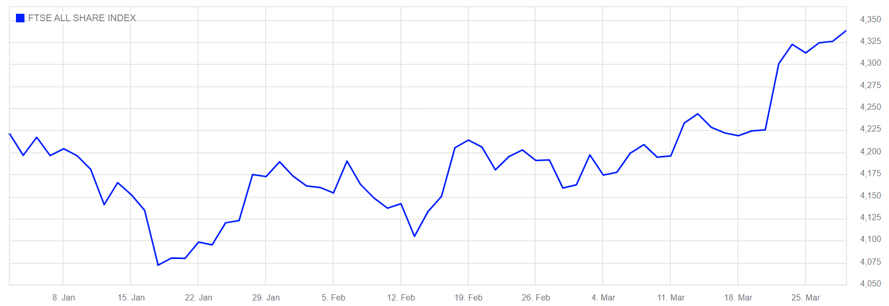

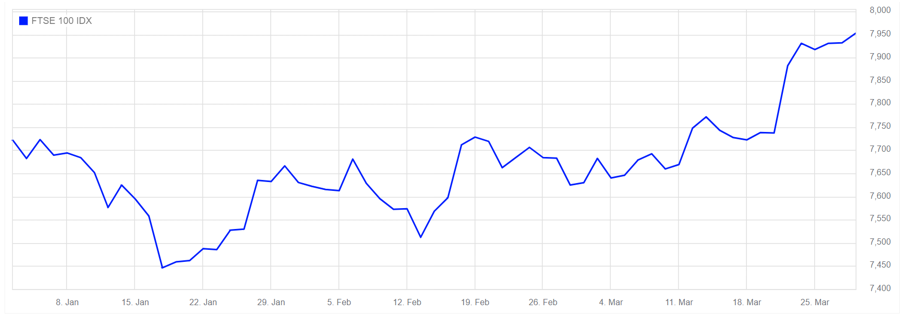

Stock market returns in the UK were positive but muted. The FTSE All-Share grew by 3.6% across the quarter, while the FTSE 100 rose by 3%.

Source: London Stock Exchange

Source: London Stock Exchange

Europe

Inflation fell unexpectedly in the eurozone from 2.6% to 2.4% in March. The European Commission revealed that economic growth for the bloc is likely to be slower than initially anticipated in 2024, but expects it to grow by around 1.5% in 2025.

Despite economic challenges, European stocks performed well in Q1. As of 28 March, the Stoxx Europe 600 index had risen by 12% since the beginning of the year, the German Dax index had risen by 8%, and the French CAC 40 had risen by 11%.

US

The US economy avoided a recession in 2023, as data revealed that GDP increased by 3.3% year-on-year in Q4, above economists’ prediction of 2%. The Purchasing Managers’ Index indicated that manufacturing output also increased. The survey scored 50.3 in March; a score of 50 or above suggests growth while below 50 suggests contraction.

Inflation data also showed that price rises are slowing. The Personal Consumption Expenditures index rose by 2.7% year-on-year, down from 5.9% at the same time last year.

The strong economic performance was reflected on the stock markets. In Q1, the S&P 500 rose by 10.6% (as shown below), the Nasdaq Composite rose by 9.1%, and the Dow Jones rose by 5.6%.

Source: Yahoo Finance

Asia

The Japan TOPIX was the best-performing index of the quarter, returning 18.1% since the beginning of 2024. This occurred as the Bank of Japan ended its eight-year negative interest rate policy; the central bank raised rates to 0 – 0.1% in March.

In China, economic performance seemed to improve following the Lunar New Year, and the People’s Bank of China lowered the five-year loan prime rate, which boosted investor sentiment further. Consequently, the MSCI China Index rose by 12.3%.

Get in touch

If you need advice on any aspect of our Q1 2024 investment update, please get in touch. To find out what we can do for you, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

The value of your investments (and any income from them) can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance. Investments should be considered over the longer term and should fit in with your overall attitude to risk and financial circumstances.

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only.

Production

Production