According to the Guardian, in November 2022 inflation dropped at its fastest rate for 16 months. As inflation measures the rate at which the cost of living is rising, seeing it drop from 11.1% in October to 10.7% in November was probably very welcome.

While the soaring cost of living may not affect your lifestyle if you’re working, it may be a different story if you’re retired or retiring. If you are, high inflation could present you with a financial headache, as it could mean you have to take more money out of your pension pot just to maintain your standard of living.

Because of this, your retirement fund could be depleted much earlier than expected, which could result in you having to significantly reduce your standard of living. One way you could protect against this is to consider an annuity, which provides a guaranteed income for life.

While annuities were once the norm in retirement, they fell out of favour after the introduction of the 2015 Pension Freedoms legislation. Yet in 2022 they have increased in popularity again. Read on to find out why, and whether an annuity might be something you should consider.

Pension Freedoms legislation provided options

Before the Pension Freedoms legislation of 2015, people who were retiring bought an annuity with their pension pot, as it provided a guaranteed income for life. Once the annuity was agreed though, it could not be changed or paused.

Furthermore, if the recipient died early, there were usually no rebates, meaning annuities could be poor value for money.

This all changed with the Pension Freedoms legislation of 2015, which offered retirees with a defined contribution (DC) pension – otherwise known as a “money purchase” scheme – more flexibility about how they accessed their pension pot.

As a result of the legislation, retirees can access their pot in one of five ways:

- Take all of the pension pot as a cash lump sum

- Take several cash lump sums

- Buy an annuity

- Take an income from the pension

- Take a mix of these options.

The flexibility provided by the legislation allows retirees to access their pension in a way that suits them. This is known as “flexi-access drawdown”.

For example, if you wanted to take a reduced level of income at the beginning of retirement because you work part-time, you can. Furthermore, any money that you do not withdraw from your pension pot typically remains invested, which exposes it to future growth potential. This could help boost its value, which in turn, could provide a better standard of living.

This exposes it to future growth potential. This helps boost its value, which in turn, could provide a better standard of living.

Annuity rates have plummeted in recent years

Soon after the legislation came into force the rates being offered for annuities dropped significantly. This had nothing to do with the legislation though, it was because of historically low gilt yields, which are used to calculate the level of income an annuity pays.

With all this in mind, you might assume that flexi-access drawdown is the better option when retiring. If so, care needs to be taken, as the increased flexibility may also mean increased risk.

This is because you could inadvertently take too much money from your pension pot and deplete it too soon. The risk of this is heightened when inflation rises, as it has done in 2022, something demonstrated by the following illustration.

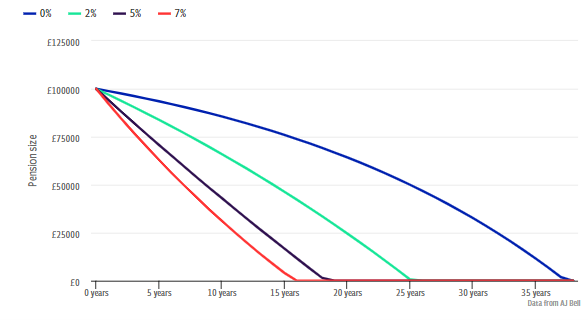

It was featured in the Telegraph, and uses an example of someone with a £100,000 pension who intends to draw £5,000 each year in retirement. The illustration assumes investment growth at 4% net of charges.

It shows how much quicker the pension runs out when the retiree increases the income by the rate of inflation to maintain an income equivalent to the original £5,000 a year. The inflation rates used in the calculations were 0%, 2%, 5% and 7%.

Source: the Telegraph

As you can see, at higher levels of inflation you could exhaust your pension pot much more quickly than you might think. This could result in you having to significantly reduce your standard of living in retirement.

An annuity may be something you want to consider

According to FTAdviser, annuities have grown in popularity in 2022 as more people look for a guaranteed income in retirement amid the cost of living crisis. The increase in popularity has also been driven by a significant increase in annuities rates, which the Financial Times revealed had soared by 40% in November.

Because of this, the Financial Times explains, a 65-year-old with a £500,000 pension pot could purchase a single-life level annuity of around £36,000 a year. This is £10,500 more than they would have received 12 months earlier.

The calculations also include a “five-year guarantee”, which means that if they die early their beneficiaries could receive a lump sum equivalent to five years of pay-outs.

As you can see, this might provide you with peace of mind that you can maintain your standard of living whatever happens or for however long you live. Furthermore, as you may be able to link your annuity to the rate of inflation, the income you receive could also maintain its spending power.

You may want to think about an annuity and flexi-access drawdown

Instead of deciding between flexi-access drawdown or an annuity, you might want to consider both. The annuity could help ensure that you can meet your financial commitments, while the flexi-access drawdown could be used for discretionary expenses such as holidays or a new car.

Furthermore, an annuity could also provide your spouse with an income for the rest of their life if you die first, which could provide peace of mind that they should be able to maintain their lifestyle.

Get in touch

If you are considering an annuity as part of your retirement strategy and would like to discuss whether it’s right for you, please contact us on admin@stonegatewealth.co.uk or by calling 01785 876222.

Please Note

This article is for information only. Do not act based on anything you might read in this article. All contents are based on our understanding of HMRC legislation, and levels, bases and reliefs from taxation may be subject to change.

A pension is a long-term investment. The fund value may fluctuate and can go down, which would have an impact on the level of pension benefits available. Your pension income could also be affected by the interest rates at the time you take your benefits. The tax implications of pension withdrawals will be based on your individual circumstances, tax legislation and regulation, which are subject to change in the future.

Production

Production