As the world entered its second year living with coronavirus, the markets remained mostly optimistic. After Covid’s impact on the global economy, the World Bank offered some upbeat news, predicting the world’s economy would grow by 5.6% in 2021, the fastest rate recorded in 80 years.

However, it also warned that poor nations are at risk of falling further behind wealthy countries amid slower vaccination progress.

In the UK, Bank of England governor, Andrew Bailey, increased Britain’s growth forecast to 7.25% for 2021, but also noted that the UK has lost two years of output growth due to the pandemic. As Q2 ended, around 45 million people in the UK had received at least one dose of the Covid vaccine.

While China was one of the first economies to post signs of recovery following the pandemic, there are now fears of inflation.

President Joe Biden secured an infrastructure deal for America worth £720 billion ($1 trillion) to upgrade roads, bridges and broadband networks in the run up to 2029. Yet this fell short of the £1.6 trillion ($2.3 trillion) spending plan announced in March.

Read on to see more updates from Q2.

UK

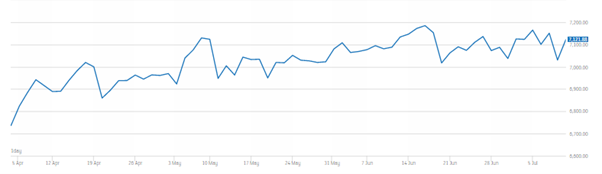

While Q2 performance for the UK markets was mixed, overall the FTSE 100 performed well, finishing above 7,100, as shown in the table below.

Source: London Stock Exchange

That said, the index struggled towards the end of the quarter because of fears about a rise in Delta variant infections, despite millions of people receiving vaccinations.

As retail outlets reopened in April following months of closures, sales jumped by 9.2%, according to the Office for National Statistics (ONS). A knock-on effect was inflation jumping to 2.5% in June due to consumer spending, following inflation that stood at 2.1% in May and 1.5% in April.

The Nationwide Building Society reported that house prices increased 10.9% in May year-on-year, prompting Sir Dave Ramsden, deputy governor at the Bank of England, to say it was monitoring the housing market carefully.

There was good news about employment, with the UK’s jobless rate dropping to 4.7% between February and April. The number of furloughed workers also fell significantly, as food and entertainment sectors reopened.

There was also welcome news when the manufacturing index of the IHS Markit Purchasing Managers Index (PMI) reached 65.6. This is the highest it’s been since the survey began in 1992, with any reading above 50 indicating growth.

Its service sector index hit a 24-year high at 62.9, implying the economy is growing quickly.

While the pandemic has meant the trade implications of Brexit have been difficult to measure, figures from the Office for National Statistics reveal exports remain below pre-Brexit levels.

Europe

Many European countries saw Covid-19 infections fall over the quarter and an acceleration in the vaccine roll-out meant restrictions could be loosened.

The European Commission signed off on the first of the national recovery plans, which will provide £682 billion (€800 billion) of funding.

Economic data suggested a strong rebound in activity in Q2, with PMI rising to 59.2 in June, its highest level since June 2006. The news was welcome following the Eurozone entering a technical recession in May.

Inflation in the Eurozone was estimated at 1.9% in June, down from 2.0% in May.

Eurozone firms also reported that new orders accelerated at their fastest pace since June 2006, boosting hopes of a sustained recovery.

That said, an issue facing many EU businesses was the supply of microchips, which impacted on car production in particular.

US

The second quarter saw a strong performance for US equities with the S&P 500 reaching a new all-time high in late June. Tech giants Apple, Alphabet, and Microsoft made strong gains in Q2.

Growth in consumption was especially strong. Industrial activity, measured by the US composite purchasing managers’ index (PMI), moved from 59.7 in March to a composite reading of 63.9 in June. This indicates strong growth.

At the end of the quarter, the International Monetary Fund (IMF) raised the US’s growth forecast to 7% following a strong recovery from the pandemic and a belief that President Biden’s spending plans will go ahead.

In May, inflation came under the spotlight, with the Consumer Price Index (CPI) inflation rising from 3% to 3.8% year-on-year. It was the largest increase since June 1992.

At the beginning of June, the US announced then immediately suspended tariffs on certain goods from the UK, Italy, Spain, Austria, India, and Turkey over a digital services tax. The US claims the tax discriminated against US technology companies and is inconsistent with the principles of international taxation. The tariffs were suspended for up to 180 days.

Asia

The MSCI Asia (ex Japan) Index recorded a positive return in the second quarter amid continued investor optimism. Stocks did become more muted towards the end of Q2, though, with the rise of Covid Delta variant infections.

Pakistan saw rising rates of Covid infections during the quarter, and its low vaccination rate prompted fears it might be hit by another wave of the virus.

Japanese shares underperformed when compared to other developed markets in Q2. Recently released economic data brought Japan’s capacity for a fast recovery later in 2021 into question, and the country’s industrial production data was weaker than expected.

The latter was the result of curtailed auto production due to the global shortage of semiconductors.

China and Hong Kong also achieved modest gains during the quarter, although fears that China could see rising inflation were strengthened by the latest Producers Price Index (PPI). It measures the cost of goods sold by manufacturers, and revealed a year-on-year increase of 6.8% in prices.

Get in touch

If you would like to discuss your investments and their performance during Q2, please get in touch using our email admin@stonegatewealth.co.uk or by calling us on 01785 876222.

Production

Production