Many countries have spent most of 2022 dealing with the consequences of the war in Ukraine and soaring inflation, and Q4 was no different. Because of this, the Bank of England (BoE) and other central banks around the globe increased their interest rates to help deal with high inflation.

There was some relief in November when Head of the International Monetary Fund (IMF) Kristalina Georgieva, suggested that inflation could be nearing its peak. That same month the UK’s inflation rate dropped slightly, suggesting that this might be the case.

What this means for interest rates remains to be seen, as the Organisation for Economic Cooperation and Development (OECD) urged central banks around the world to keep raising interest rates to deal with inflation.

Read on to discover more about the events of Q4 2022, and how they affected the markets.

UK

In October, the then prime minister Liz Truss resigned in the wake of Kwasi Kwarteng’s disastrous mini-Budget. When Rishi Sunak became PM later that month, it capped a year where Britain had seen four chancellors and three prime ministers enter Downing Street.

In November the chancellor, Jeremy Hunt, unveiled his autumn statement, in which he extended the freeze on several tax allowances until 2028. He also announced that exemptions on some other taxes, such as Capital Gains Tax and Dividend Tax, will reduce from April 2023.

The political situation in Britain did nothing to calm fears that the UK was about to fall into a recession. This was backed up in November by the S&P Global’s purchasing managers index (PMI), which suggested that business output was falling.

It pointed to Brexit, logistical challenges, high costs and falling demand, which had resulted in the PMI falling to 46.5 (any reading below 50 indicates economic contraction). In December it fell further to 45.3.

Additionally, in December the Office for National Statistics (ONS) confirmed that Britain’s economy contracted by 0.3% during the third quarter of 2022. With this in mind, it’s not surprising that experts now believe that the UK will fall into a recession in 2023.

UK inflation reached 11.1% in October, which was the highest level in 41 years. There was some good news though, as the ONS revealed November’s inflation rate dropped slightly to 10.7%, which may suggest that the soaring cost of living has peaked.

Furthermore, the BoE also stated in December that it believed inflation could fall sharply in the second half of 2023. Despite this, the central bank still increased its interest rates by 0.5% to 3.5% in December to tackle high inflation.

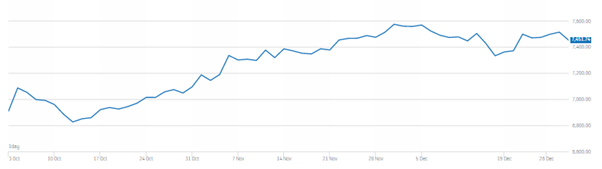

Even with all the economic and political uncertainty of Q4, the FTSE 100 ended higher than where it started the period. This is demonstrated in the following illustration, which shows the index’s performance.

Source: London Stock Exchange

Europe

Like Britain, Europe spent much of Q4 dealing with the risk of recession and high inflation rates affecting business confidence. The energy crisis was the biggest factor, which increased the rate of inflation.

According to Euronews, in November, gas and electricity prices had nearly doubled in all of the EU’s capitals when compared to the year before. As a result of high inflation in the zone, the European Central Bank (ECB) increased its base interest rate by 50 basis points in December.

The PMI for manufacturing in the eurozone fell to a 29-month low of 46.4 in October, deepening fears that the region could soon be in a recession. Yet by December the PMI rose to 47.8, the highest level for three months.

This could be one of the reasons it’s now hoped that if Europe falls into a recession, it will not be as severe as initially thought.

After a difficult Q3, equities performed better in Q4. This is demonstrated by the following illustration, which shows the performance of the Euro Stoxx between 16 October 2022 and 2 January 2023.

Source: Euro Stoxx

US

The start of Q4 provided some optimism for the US that inflation could be stabilising. In the 12 months leading up to October 2022 it was 7.7%, yet it then dropped to 7.1% in November. Other statistics from the US painted a mixed picture though, with PMI data suggesting that manufacturing output was shrinking.

It fell from 47.7 in November to 46.2 in December, which shows a contraction. This countered more positive data regarding employment, which suggested that businesses in the US remained broadly optimistic and felt confident enough to invest in their workforce.

In November, 260,000 new jobs were added to the job market and the unemployment rate held at 3.7% – an almost 50-year low.

Asia

Following confirmation that Chinese Premier Xi Jinping would remain as leader for a third five-year term in October, equities dropped due to a sell-off in China and Hong Kong. Then in November, equities largely recovered after US President Joe Biden and the Chinese leader signalled a desire to improve US-China relations.

After a difficult October, Chinese equities saw better performance in November. This was due to expectations that demand will recover in 2023 as the authorities re-open the economy and provide further economic stimulus.

Get in touch

If you need advice on any aspect of our Q4 investment update, please get in touch. If you would like to discuss how investing might benefit your wealth, or discover how we might be able to help your finances, email admin@stonegatewealth.co.uk or call us on 01785 876222.

Please note

This blog is for general information only and does not constitute advice. The information is aimed at retail clients only. The value of your investment can go down as well as up and you may not get back the full amount you invested. Past performance is not a reliable indicator of future performance.

Production

Production